Today, we dispel the decades-old myth that performance must be sacrificed when investing responsibly in Sustainable/ESG assets. This myth rises again and again like Freddy Krueger in a horror movie, and, like Freddy, the myth should be laid to rest.

Sustainable ESG Investing Performance

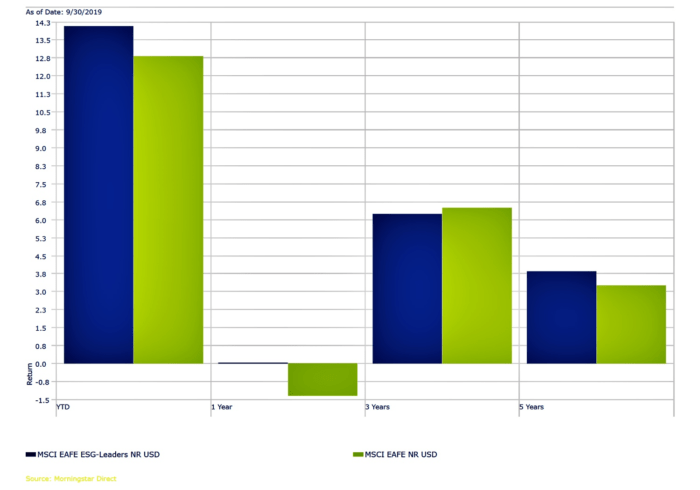

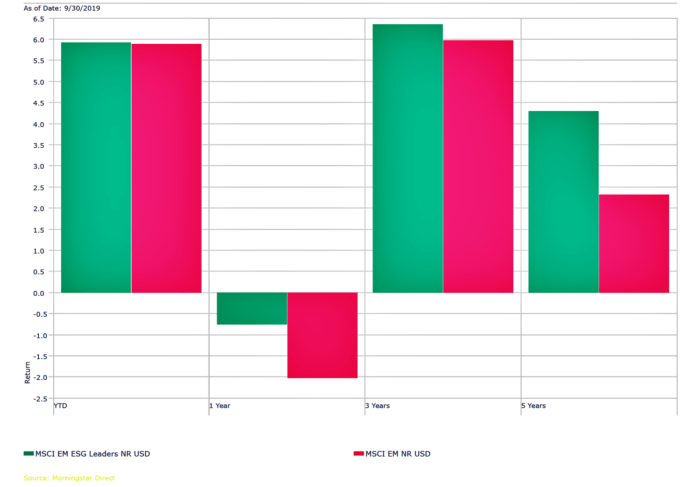

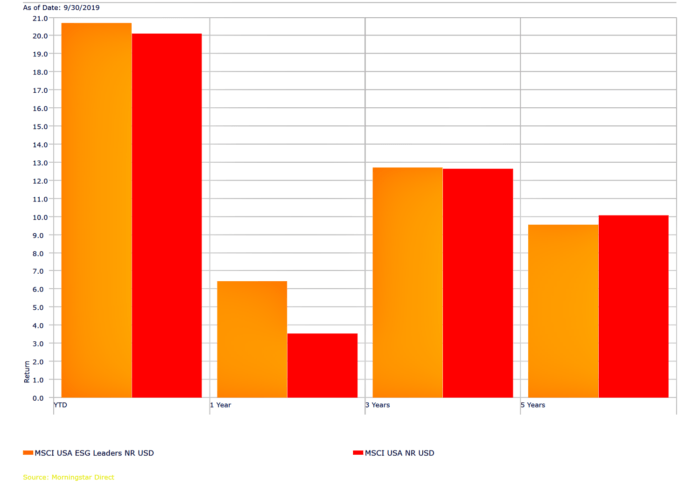

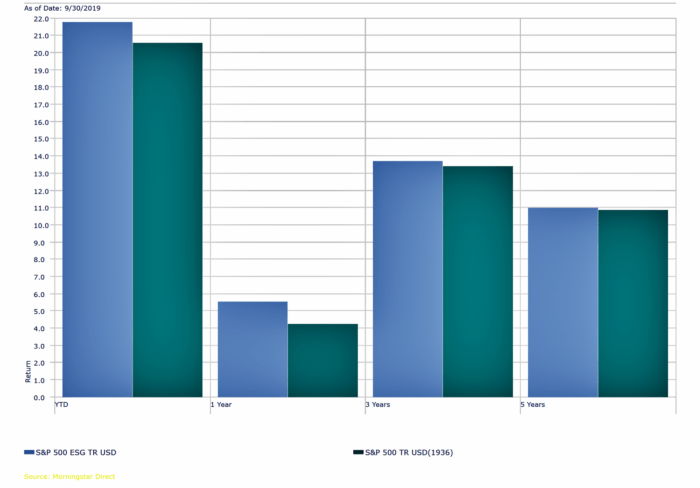

Below, we share four graphs comparing the performance of broad indexes vs the same indexes filtered through an ESG screen. Based on the 5-year index performance comparisons, we see that ESG index performance is in line with traditional broad indexes.

The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries around the world, excluding the US and Canada.

MSCI EAFE ESG-Leaders – BLUE

MSCI EAFE Index – LIME

The MSCI Emerging Markets Index measures equity market performance in global emerging markets and represents 13% of global market capitalization.

MSCI EM ESG-Leaders – GREEN

MSCI EM (Emerging Markets) – ROSE

MSCI USA Index is a market capitalization weighted index which measures the performance of equity securities in the top 85% by market capitalization of equity securities listed on stock exchanges in the United States.

MSCI USA ESG-Leaders – ORANGE | MSCI USA – RED

The S&P 500 is a stock market index that tracks the stocks of 500 large-cap U.S. companies.

S&P 500 ESG – BLUE | S&P 500 – GREEN

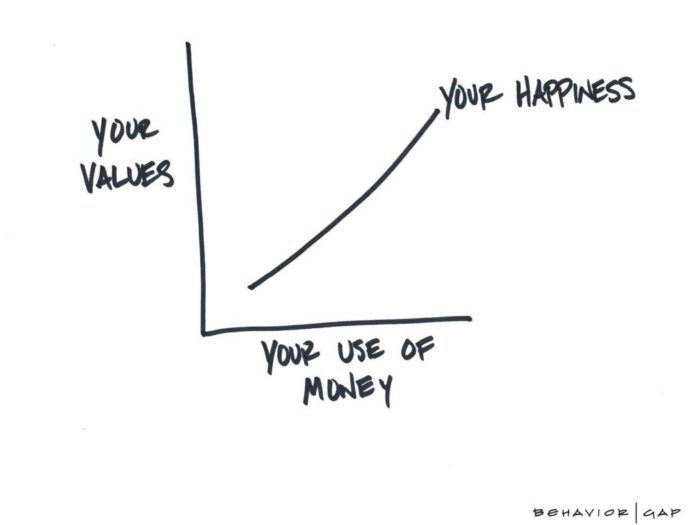

If you appreciate the prospect of investing in companies that are well managed, equitable, and good corporate citizens, don’t be surprised if shifting to Sustainable/ESG investing brings positivity to your financial life. As Katherine Collins, Head of Sustainable Investing at Putnam Investments says: “You see consumers, employees, and investors increasingly reconnecting elements of environmental, social, and governance factors into their decision-making. Whether it’s a decision on where to work, a decision on what to buy, a decision on where to invest.”

For those who care about the world and people around us, the time is now to make a positive change and align your investments with your values, beliefs, and causes. These graphs begin to tell the performance story. Stay tuned.

MORE ON ESG: Frequently Asked Questions About Sustainable/ESG Investing

Please Note:

Comparisons are not provided as a recommendation to invest in specific funds, but as broad conceptual evidence that positive ESG-focused investing does not lag in performance vs. traditional.

All indexes are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indexes do not incur management fees, charges, or expenses. Past performance does not guarantee future results.

Today, we dispel the decades-old myth that performance must be sacrificed when investing responsibly in

Today, we dispel the decades-old myth that performance must be sacrificed when investing responsibly in

For those who care about the world and people around us, the time is now to make a positive change and align your investments with your values, beliefs, and causes. These graphs begin to tell the performance story. Stay tuned.

For those who care about the world and people around us, the time is now to make a positive change and align your investments with your values, beliefs, and causes. These graphs begin to tell the performance story. Stay tuned.