Maximizing Generosity: Understanding Annual Gift Exclusions and Strategies

In a world where financial planning plays a pivotal role in securing the future of our loved ones, questions about gifting often arise. How much can you give to your children and grandchildren without worrying about gift taxes? The answer is straightforward, but the intricacies surrounding it can significantly impact your ability to provide for your family. In this blog post, we’ll delve into the annual gift exclusion and explore strategies to make the most of your generosity. Understanding the…

READ MORE ⟶Secure Your Retirement: Qualified Longevity Annuity Contracts

In an era where retirement planning has become increasingly complex, individuals are searching for ways to secure their financial future and ensure a comfortable life during their later years. One innovative tool that has gained prominence in retirement planning discussions is the Qualified Longevity Annuity Contract, or QLAC. Designed to address the challenges posed by increased life expectancy and provide a guaranteed income stream in retirement, QLACs offer a unique approach to managing longevity risk. In this StampNote, we’ll delve…

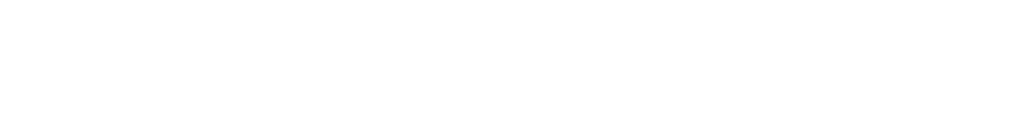

READ MORE ⟶The In-Service Withdrawal Strategy Explained

Learn how to gain more control over your retirement planning with the little-known but powerful in-service withdrawal strategy! Cary Stamp shares insights on how you can utilize this technique to unlock a world of investment possibilities, reduce fees, and even convert traditional retirement funds to tax-free Roth IRA accounts. Watch now and take charge of your retirement! TRANSCRIPT: Hi, I’m Cary Stamp with Cary Stamp and Co. And today I want to talk about how you can get some flexibility…

READ MORE ⟶Looking Back at 2022, with Best Wishes for a Wonderful Holiday Season.

With a new year on the horizon, many of us will be glad to look at 2022 in the rearview mirror. While this year has provided challenges, I think it will also set up some opportunities in the year ahead. I thought this might be a good opportunity to share some updates on the firm from the past year and what we we’ll be working on in the coming year. In January, Sharon and I will celebrate our 25th anniversary.…

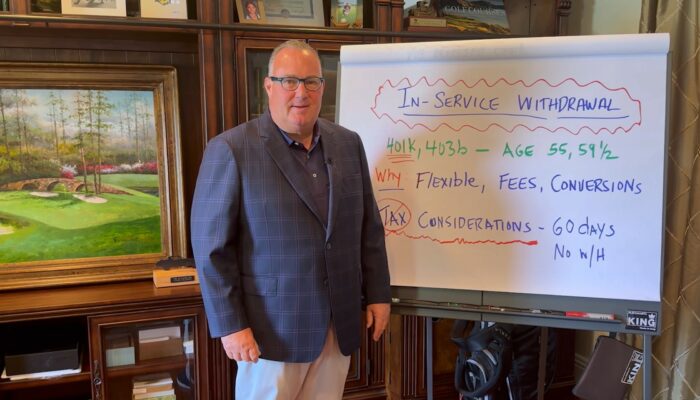

READ MORE ⟶How to Maximize Fine Art Donations to Charities

Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP®, combines his passion for fine art with decades of financial knowledge to share key issues involved in donating fine art to charities. There are some details that make all the difference. TRANSCRIPT: One of my passions is the art world and understanding art. And I like to couple that with my knowledge of finance and figure out how I can use one passion to feed off and to help the other. I want…

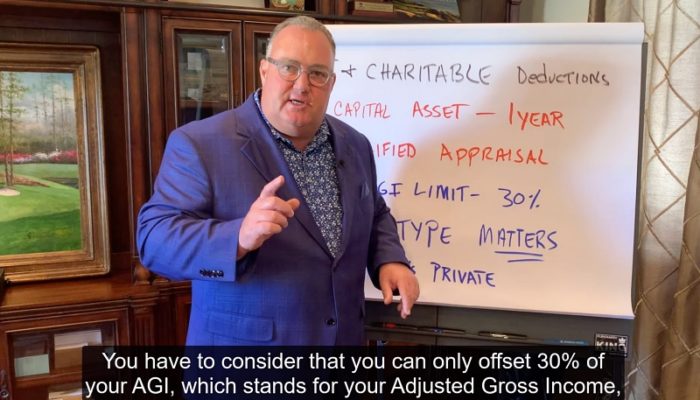

READ MORE ⟶Have College-Aged Kids and Family Income Higher than $160,000? These Tax Credits are for You.

Tax Credits for College-Aged Kids You may be making a mistake if your kids are college-age and you’re not taking advantage of the American Opportunity Tax Credit and Lifetime Learning Credit. In this video, Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP®, provides an overview of these two significant tax credits available to families with more than $160,000 in income. TRANSCRIPT: If you and your family have an income greater than $160,000 and you have kids that are over age 17…

READ MORE ⟶Reduce Healthcare Costs and Save For Retirement with One Mighty Little Health Savings Account

Here’s one financial decision you will not regret: enrolling in a Health Savings Account (HSA) at work to reduce your healthcare costs. Learn about the triple tax-reducing power of the Health Savings Account to lower your healthcare costs, and how it can help pay for health expenses from early career all the way through retirement. It may sound too good to be true, but not so, as wealth strategist Josh Weller, AIF® RICP® explains… A FEW ADDITIONAL POINTS NOT COVERED…

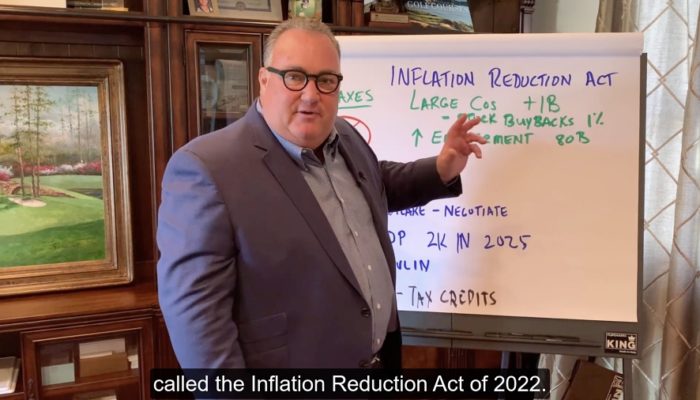

READ MORE ⟶What You Need to Know About the Inflation Reduction Act of 2022

Here’s Cary’s quick summary of key takeaways from the Inflation Reduction Act signed by the president last week, with emphasis on how it may affect you and your family. Recently, the US Congress, House and Senate and Joe Biden signed off on legislation called the Inflation Reduction Act of 2022. The act has a bunch of provisions that were originally intended to be in the Build Back Better legislation that Biden originally proposed. Let’s walk through some of those things…

READ MORE ⟶Do You Have to Pay Capital Gains on Selling Your Home?

When selling your home, you may be eligible for a substantial capital gains tax exclusion ranging up to $500,000 in excluded gains. Financial analyst Matt Mellusi, MSFP, of Cary Stamp & Co. in Tequesta, FL introduces the basics of the $250,000/$500,000 Home Sale Tax Exclusion. TRANSCRIPT: I’m Matt with Cary Stamp and Company and today I want to share with you about a tax break you may be eligible for if you’re selling your home. If any kind of asset…

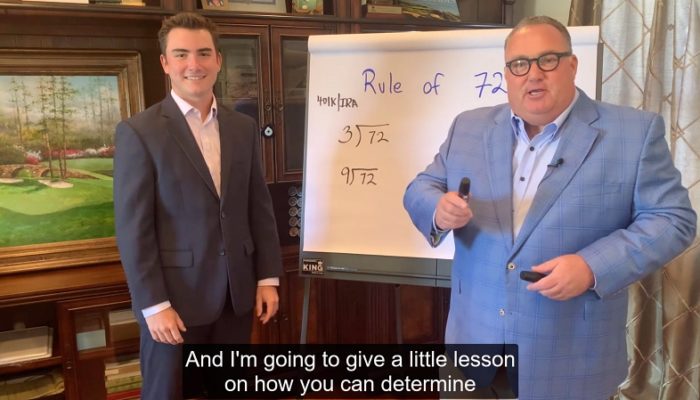

READ MORE ⟶How Long Will it Take to Double Your Investment? The Rule of 72

The Rule of 72 is a simple arithmetical equation approximating how long to double your investment at an annual rate of return. In this video, Cary Stamp, CFP® and financial analyst Austin Kuyrkendall explain the power of investing your assets over the long term at a higher rate of return, using the Rule of 72. TRANSCRIPT Cary: I’m Certified Financial Planner, Cary Stamp with Cary Stamp and Company and I have my associate Austin Kuyrkendall with me today because we…

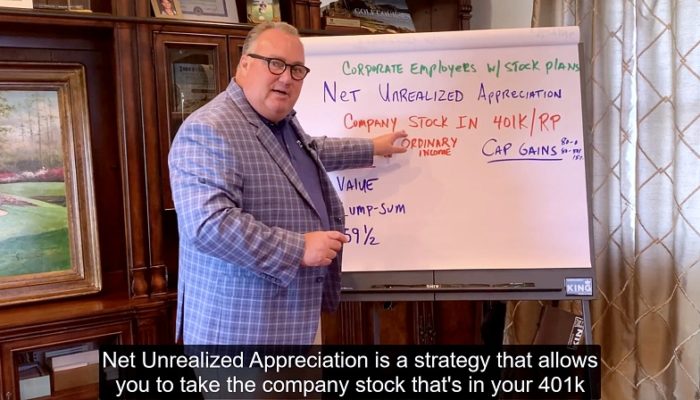

READ MORE ⟶Have You Accumulated a Substantial Amount of Company Stock as an Employee? Here’s How to Make the Most of It!

Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP® of Jupiter, FL, illustrates the huge tax advantage of using the Net Unrealized Appreciation strategy when distributing your employee-owned stock. TRANSCRIPT: My name is Cary Stamp. I’m a certified financial planner and founder of Cary Stamp & Company. And if you are an employee of a large corporation that has stock as an offering, either in your 401k plan or some other type of retirement plan, I am talking to you. And please…

READ MORE ⟶Cary Stamp & Co. Named One of Ten “Charitable Champions” in the Nation.

The Invest in Others Charitable Foundation (“Invest in Others”) has announced the selection of 10 financial advisory firms for its annual Charitable Champions List, which recognizes companies that give back to their communities and successfully promote a culture of philanthropy within their organizations. Cary Stamp & Co., Principled Wealth Advisors, of Tequesta, FL is among the select Charitable Champions on this year’s list. In 2021, the 10 Invest in Others (IiO) Charitable Champions raised a total of $2,095,952 in monetary…

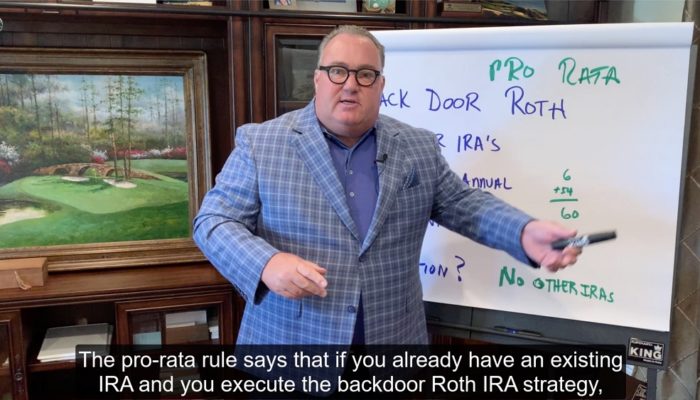

READ MORE ⟶Learn the One Big Caveat About the Backdoor Roth: the Pro-Rata Rule

Here’s the big question to ask yourself before starting a “backdoor” Roth IRA strategy. Do you already have other IRAs? In this video, Forbes Best-In-State wealth manager Cary Stamp, CFP® explains how the Backdoor Roth Pro-Rata Rule impacts the tax efficiency of the backdoor Roth IRA, and provides the potential solution! TRANSCRIPT: I’m Certified Financial Planner Cary Stamp. This is going to be a Principled Wealth Moment on what to watch out for when you’re doing the backdoor Roth IRA.…

READ MORE ⟶A No-No for High Earners: Overlooking the Optimal Timing for Claiming Social Security

The maximum monthly Social Security benefits for 2022, and why the timing of claiming benefits is important for everyone. As high earners approach retirement, too many overlook the importance of claiming social security benefits at the optimal time. A number of personal reasons or assumptions are to blame for the blasé attitude. The most common is the perception that the claiming decision won’t make a difference in their finances. Another is a misguided assumption that the social security system will…

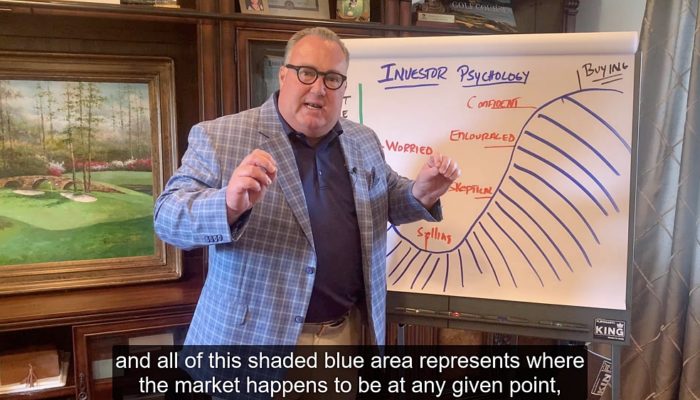

READ MORE ⟶The Fatal Flaw in Investor Psychology During Market Corrections

We’ve all heard the old stock market adage “Buy Low, Sell High.” But it’s easier said than done. Investor psychology during corrections can play tricks with the mind and this leads many people to sell low and buy high. In this video, Cary Stamp, CFP®, a Forbes Best-In-State Financial Advisor, explains the nature of investor psychology during a market correction, what to watch out for, and the best mindset for success. TRANSCRIPT: I’m Cary Stamp, founder of Cary Stamp…

READ MORE ⟶Cary Stamp, Founder of Cary Stamp & Co., Named on Forbes Best-In-State Wealth Advisors List for Second Consecutive Year.

Stamp again on Forbes Best-In-State list spotlighting top regional financial advisors throughout the country. Tequesta, FL (April 18, 2022) Cary Stamp & Co., Principled Wealth Advisors, a provider of financial advisory services based in Palm Beach County, FL, announced that founder Cary Stamp, CFP® has been named a Forbes Best-In-State Wealth Advisor for 2022. This is the second consecutive year that Stamp has been named. The list is published online at: https://www.forbes.com/best-in-state-wealth-advisors. According to Forbes, a leading U.S. financial publication, the list spotlights…

READ MORE ⟶Should Nuclear Energy Have a Place in Sustainable Investing?

With Nuclear Energy’s Potential Contribution to the Net Zero Climate Change Solution, Is It Time to Start Asking the ESG Question? by Josh Weller, AIF® RICP® At the time of the largest nuclear accident in U.S. history, I lived 81.4 miles northeast of Londonderry Township, PA, the site of the infamous event at Three Mile Island. Six months later, the famed MUSE Concerts For a Non-Nuclear Future (No Nukes) were held at Madison Square Garden, mobilizing a social-political movement and…

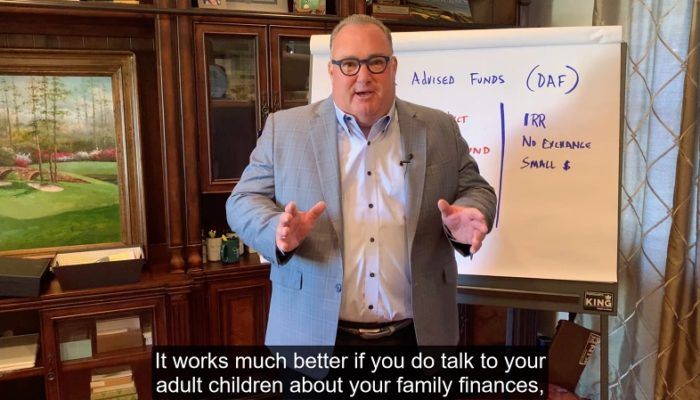

READ MORE ⟶Donor Advised Fund Advantages vs Private Foundations

Surprisingly, Donor Advised Funds and Foundations Don’t Really Have Much in Common Other Than Philanthropic Impact. The two most popular charitable vehicles for donors who possess considerable assets are the Donor Advised Fund and Private Foundation. The two have obvious differences and the contrast leads to a clear choice for most donors. A donor-advised fund (or DAF) functions much like a combination savings and investment account for charitable assets. The donor creates the fund through a financial institution, community foundation,…

READ MORE ⟶Put Your Values Into Action. Create a Lasting Legacy with Multigenerational Family Philanthropy

Forbes Best-In-State Wealth advisor Cary Stamp, CFP®, introduces the concept of multigenerational family philanthropy, outlining the profound benefits of including teen and adult children in philanthropic discussions. VIDEO TRANSCRIPT: Hi, I’m Cary Stamp, I’m a Certified Financial Planner and I’m a Chartered Advisor in Philanthropy, and I’d like to talk today about how you can talk to your adult children about financial matters. Many of us don’t talk to our kids about money, and in fact, if you’re of my…

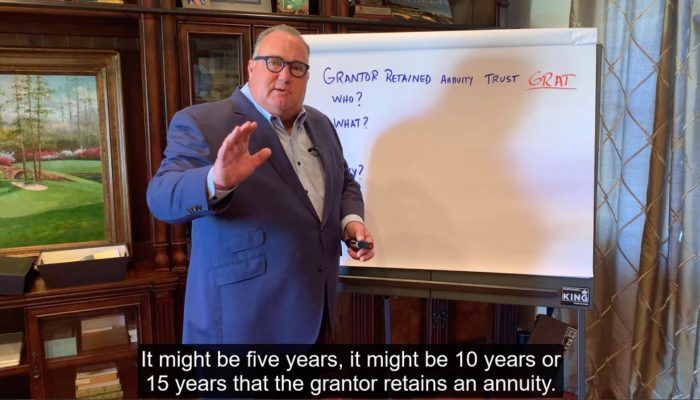

READ MORE ⟶Turbocharge Long-Term Gifts to Your Kids with a Grantor Retained Annuity Trust (GRAT).

Cary Stamp, Forbes Best-In-State wealth advisor, presents a sophisticated estate planning strategy that produces income for the grantor while tax-efficiently turbocharging gifts to children and other family members. It’s called the Grantor Retained Annuity Trust (GRAT). VIDEO TRANSCRIPT: I’m Cary Stamp, I’m a Certified Financial Planner and an Accredited Estate Planner with Cary Stamp and Company in Tequesta, Florida. Today, I’m going to talk about a subject that can help you turbocharge gifts that you’re making to your children through…

READ MORE ⟶