Here’s one financial decision you will not regret: enrolling in a Health Savings Account (HSA) at work to reduce your healthcare costs. Learn about the triple tax-reducing power of the Health Savings Account to lower your healthcare costs, and how it can help pay for health expenses from early career all the way through retirement.…

READ MORE ⟶When selling your home, you may be eligible for a substantial capital gains tax exclusion ranging up to $500,000 in excluded gains. Financial analyst Matt Mellusi, MSFP, of Cary Stamp & Co. in Tequesta, FL introduces the basics of the $250,000/$500,000 Home Sale Tax Exclusion. TRANSCRIPT: I’m Matt with Cary Stamp and Company and today…

READ MORE ⟶The Invest in Others Charitable Foundation (“Invest in Others”) has announced the selection of 10 financial advisory firms for its annual Charitable Champions List, which recognizes companies that give back to their communities and successfully promote a culture of philanthropy within their organizations. Cary Stamp & Co., Principled Wealth Advisors, of Tequesta, FL is among…

READ MORE ⟶The maximum monthly Social Security benefits for 2022, and why the timing of claiming benefits is important for everyone. As high earners approach retirement, too many overlook the importance of claiming social security benefits at the optimal time. A number of personal reasons or assumptions are to blame for the blasé attitude. The most common…

READ MORE ⟶Stamp again on Forbes Best-In-State list spotlighting top regional financial advisors throughout the country. Tequesta, FL (April 18, 2022) Cary Stamp & Co., Principled Wealth Advisors, a provider of financial advisory services based in Palm Beach County, FL, announced that founder Cary Stamp, CFP® has been named a Forbes Best-In-State Wealth Advisor for 2022. This…

READ MORE ⟶With Nuclear Energy’s Potential Contribution to the Net Zero Climate Change Solution, Is It Time to Start Asking the ESG Question? by Josh Weller, AIF® RICP® At the time of the largest nuclear accident in U.S. history, I lived 81.4 miles northeast of Londonderry Township, PA, the site of the infamous event at Three Mile…

READ MORE ⟶Surprisingly, Donor Advised Funds and Foundations Don’t Really Have Much in Common Other Than Philanthropic Impact. The two most popular charitable vehicles for donors who possess considerable assets are the Donor Advised Fund and Private Foundation. The two have obvious differences and the contrast leads to a clear choice for most donors. A donor-advised fund…

READ MORE ⟶NEW YORK, August 17, 2021 – Inc. magazine today revealed that Cary Stamp & Co., the Principled Wealth Advisors™ based in Palm Beach County, FL, has premiered at No. 4689 on its annual Inc. 5000 list, the most prestigious ranking of the nation’s fastest-growing private companies. The list represents a unique look at the most…

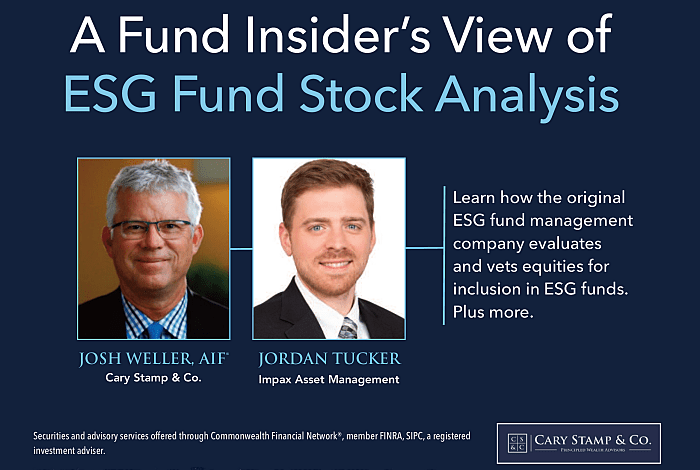

READ MORE ⟶A brief conversation with financial advisor and ESG specialist Josh Weller, AIF® and Jordan Tucker of Impax Asset Management https://youtube.com/watch?v=qY1ydaeEnvg Jordan Tucker of Impax Asset Management and PAX funds joins Josh Weller AIF® for a topical discussion about how Impax and PAX World Funds evaluate equities for inclusion in ESG funds. This is a subject…

READ MORE ⟶Stamp joins the Forbes Best-In-State list spotlighting the top regional financial advisors throughout the country. Cary Stamp & Co., a provider of financial advisory services based Palm Beach County, FL, announced that founder Cary Stamp has been named on Forbes Best-In-State Wealth Advisors for 2021 list for South Florida. The list is published online at: https://www.forbes.com/best-in-state-wealth-advisors. According to Forbes, a leading…

READ MORE ⟶