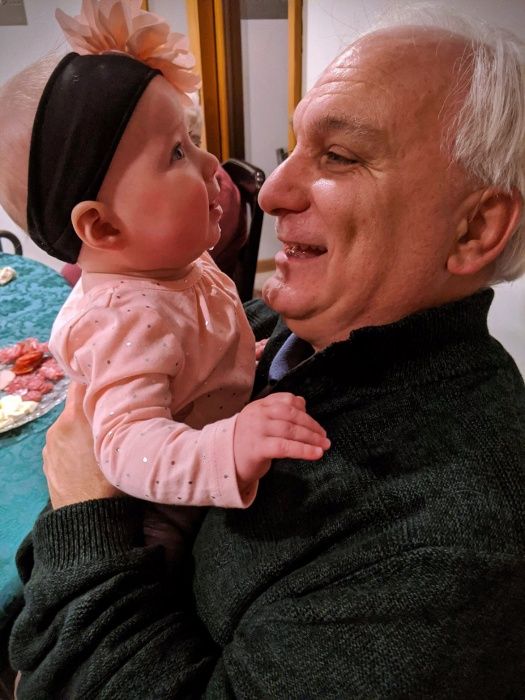

I was given a new nickname this week. “Pops!” I became a grandfather.

I was given a new nickname this week. “Pops!” I became a grandfather.

In response, I immediately let my imagination run wild and scoured the web for “tiny baseball mitts” and “really small golf clubs,” but my practical side reappeared and I thought: “what would be the most prudent action for a grandfather to take now that this little guy has entered the world?” While not a complete list, here are a few things to consider with your advisor.

WILLS & TRUSTS

Is it time to update your will? If you’ve amassed a healthy nest egg, and you’re leaving money to your kids, you may want to include your grandchild, too. If you have any special procedures ascribed to the money (such as not giving the inheritance until they hit a particular age), you’ll want to add that. While a will is useful in this regard, when leaving money to a child two generations below you (known as a skip person) the legality can be cumbersome because it will need to go through probate. Probate can be a costly and extended process and can even be contested. To avoid this, it is best to set up a trust. A trust can avoid probate and accomplish all your wishes through a 3rd party that you choose.

Appropriately defining provisions in your last will and testament are of utmost importance in reflecting your personal wishes. Your stipulations provide attributes that hopefully last beyond first-hand insight and guidance.

529 EDUCATION SAVINGS PLANS

Having put three children through college (and then two of them through law school) I never thought that educational inflation would continue at such a high level, but alas, here we are! A 529 plan is a savings account designed to help people save for college (with tax breaks for both the contributor and recipient), and often used by grandparents. It is never too early to start saving!

Should you take this route, a grandparent would invest funds for future growth and all earnings and capital gains within the account grow tax-free, as long as withdrawals from the account are used to pay for qualified education expenses such as tuition, room and board, activity fees, etc.

Many states also provide an income tax deduction for contributions made to 529 plans. When making contributions it is important to consider your own limitations and not give beyond your means. With that in mind, if you have significant means, here’s a powerful tactic. A married couple can reduce their gross estate by making a one-time lump sum joint gift of $150,000 to each grandchild’s 529 plan. This is known as the 5-year exclusion, which combines 5 annual 529 contributions of $30,000 in 2019. Talk about super charging the next generation for success and leaving a legacy!

Again, consult with a financial advisory professional to assist in the planning, set-up, and execution of your wishes.

Some non-financial ideas that may resonate:

GET IN SHAPE!

You’ve been meaning to shed a few pounds and get back to a routine of walking and exercise. There is no time like the present and no better motivator than the potential future scenarios that include those aforementioned mitts and golf clubs!

While tomorrow is never guaranteed, the mind’s images of all those UGH! moments (Unlimited Grandchild Hugs!) should make each additional step toward new personal goals that much more achievable.

Which brings us to the most important gift…

GIVE OF YOURSELF

Regardless of your wealth and the possessions you can pass on to heirs, the most precious gift is the totality of you—your time, your personality, your wisdom, and your love. The vast fortune of unconditional love helps you put your own priorities in order. Pass on your family legacy and relish in the status that no board of directors or organization can impart. Indulge with what you have, and find peace in body, mind, and spirit.

Thank you, Jacob. Get ready little man, “Pops” has a lot in store for us.