Managing your money wisely means understanding your options, and making informed decisions. Cary and his team help you take charge of your financial life by showing you how to use your money to work towards a lifetime of financial freedom. We are independent financial planners who carefully select strategies and investments that we feel will benefit you, not the investments someone has told us to “push.”

In his practice, Cary advises high-net-worth individuals, successful business owners, executives, and affluent multigenerational families with independent, insightful analysis and planning of all aspects of their financial lives.

After early career success in the brokerage field, Mr. Stamp launched his firm almost 20 years ago upon witnessing the extreme need for expert financial advice and fiduciary advocacy. He has written many articles on financial advisory topics and has been quoted in print and on wealth management broadcast media.

Cary Holds Six Professional Designations:

A frequent speaker on financial topics, Cary tailors his message to each audience’s distinct demographic and financial profile, focusing on the subjects of tax strategies; insurance, retirement, and estate planning; business succession; and the multigenerational transfer of wealth.

Cary Stamp & Co, is annually ranked among the top national producers* affiliated with Commonwealth Financial Network, the top-ranked broker-dealer for independent investments advisors in the U.S. (Commonwealth was ranked ‘Highest in Independent Advisor Satisfaction among Financial Investment Firms, by J.D. Power,* for the eighth consecutive time).

* Recognized as a Leader’s Level advisor for 2018, a distinction was on annual production attained by just 7 percent of advisors affiliated with Commonwealth.

* Commonwealth Financial Network® received the highest score in the independent advisor segment of the J.D. Power 2010, 2012, 2013, 2014, 2018, 2019, 2020, and 2021 financial advisor surveys.

Award Disclosure:

2022 Forbes Best In State Wealth Advisors, created by SHOOK Research. Presented in April 2022 based on data gathered from June 2020 to June 2021. 19,640 Advisors were considered, approximately 6,500 Advisors were recognized. Advisors pay a fee to hold out marketing materials. Not indicative of advisor’s future performance. Your experience may vary. Click here for more award information.

“We want all of our clients to experience all that life has to offer. I refer to it as the pursuit of abundance, possibility, and adventure. I’ve dedicated my professional life to helping people create a strong financial foundation for doing so, through leading-edge financial planning and intelligent asset management.”

Cary Stamp’s Posts

How To Do the Back Door Roth IRA

Cary Stamp, leading financial advisor based in Jupiter, FL, offers a quick description of the Back Door Roth IRA strategy, which is the method for contributing to a Roth IRA even if you earn too much income. TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment, and today I’m going to…

Read MoreA Time for Gratitude and Patience

Leading financial advisor Cary Stamp puts the Coronavirus crisis and market decline into perspective, discussing the need for patience and gratitude in getting to the other side. TRANSCRIPT: Hi, I’m Cary Stamp. This is a Principled Wealth Moment. I wanted to address one more time what’s going on during the Coronavirus lockdown. As we…

Read MoreHow Much Life Insurance Do You Need?

Cary Stamp, leading financial advisor based in Jupiter, FL, provides perspective on the proper amount of life insurance and the question of whether your beneficiaries would need to use the principal of life insurance proceeds for living expenses. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. I just read…

Read MoreTaking Advantage of Opportunities for Long-Term Wealth Creation

Cary Stamp—leading Jupiter, FL financial advisor—calls upon decades of experience to offer his view that the Covid-19 crisis may be a generational opportunity for long-term wealth creation. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. And I’d like you to listen to something. [knock knock knock] Do you hear…

Read More3 Investment Management Strategies for a Down Market

Leading financial advisor Cary Stamp offers three potentially profitable investment strategies for market declines. Tax Loss Harvesting, Roth IRA Conversions, and Buying Low with Dollar Cost Averaging. TRANSCRIPT: Hi, I’m Cary Stamp, this is a Principled Wealth Moment. Nobody likes a down market, but I’m going to explain how we can…

Read MoreThe Importance of Making a Difference in Your Community

Cary Stamp, leading financial advisor in Jupiter, FL, shares his perspective on making a difference in the world by giving back to local community organizations. TRANSCRIPT: I grew up in Iowa and growing up in Iowa was pretty average. I went to a public school, I got pretty good grades and…

Read MorePhenomenal Tax Credits up to $5,000 per year for Launching a New 401(k) Plan

Leading financial advisor Cary Stamp, based in Jupiter, FL, offers an overview of the exceptional tax credits up to $5,000 per year for businesses that launch new 401k plans (made available through a Secure Act provision). TRANSCRIPT: Hi, I’m Cary Samp with Cary Stamp & Co., and this is a Principled Wealth…

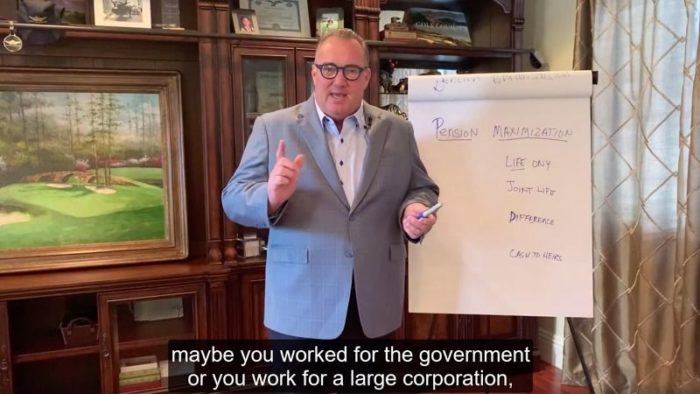

Read MoreMaximize Your Pension with a Huge Lump Sum Passed on to Beneficiaries

Jupiter, FL financial advisor Cary Stamp briefly outlines an innovative Pension Maximization strategy that can add a huge lump sum to the assets you pass on to beneficiaries. TRANSCRIPT: I am Cary Stamp with Cary Stamp and Company. This is a Principled Wealth Moment. And if you’re somebody that has a pension, maybe you…

Read MoreHow to Maximize Contributions and Tax Deductions to a Solo 401(k)

Leading financial advisor Cary Stamp provides a quick lesson on how entrepreneurs such as attorneys and real estate agents with 1099 income can maximize contributions to what’s known as a Solo or Individual 401(k). TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment. Today, I’m going to explain to you how…

Read MoreWhen to Take and How to Maximize Social Security Benefits

In this video, Cary Stamp, leading investment and financial advisor based in the Jupiter, FL area, briefly addresses one of the most common question asked of financial advisors: “When should people start taking social security benefits?”. TRANSCRIPT: Hi, I’m Cary Stamp. This is a Principled Wealth Moment. Today I’m going to talk about…

Read MoreHybrid Long-Term Care Insurance Combines Long-Term Care Benefits and Life Insurance in One Policy

Financial advisor Cary Stamp discusses the value of Hybrid Long Term Care Insurance, a powerful combination of Long Term Care Benefits with Life Insurance that preserves your capital. TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment. Today I’m going to talk about a subject that most people really don’t like…

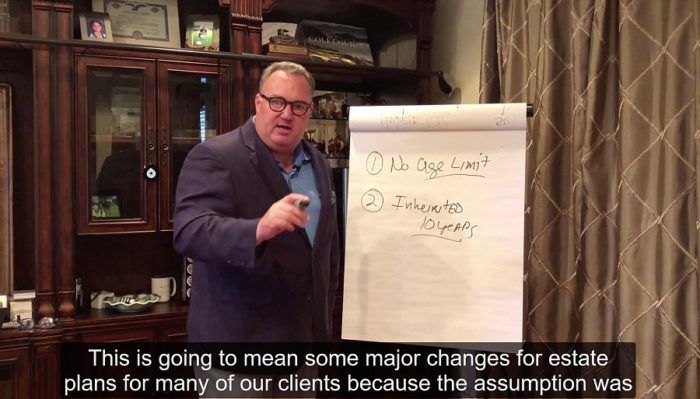

Read MoreFour Ways the Recently Passed Secure Act Will Impact Individual Investors

What’s in the Secure Act? Financial advisor Cary Stamp addresses the four primary ways the recently passed Secure Act will affect individuals and families, most notably on Individual Retirement Accounts (IRAs) and 529 Education Plans. TRANSCRIPT: What’s in the Secure Act? I’m Cary Stamp. This is a principled wealth moment. Welcome to…

Read MoreSave on Taxes with Bunched Charitable Contributions to Donor Advised Funds

Leading financial advisor Cary Stamp, CFP® discusses the tax efficiency benefits of Donor Advised Fund bunching deductions. TRANSCRIPT: Today I’d like to talk about how we can make the world a better place, and get some tax deductions all at the same time. And it’s by using a strategy that we call “Bunching Deductions.”…

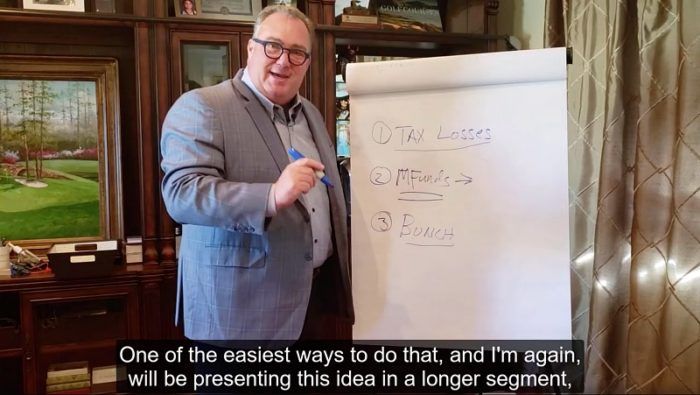

Read MoreImportant Year-End Tax Planning Ideas for Individuals and Businesses

Leading financial advisor Cary Stamp, CFP® provides five year-end tax planning ideas: three for individuals, and two for businesses. Ideas include tax loss selling, avoiding high mutual fund capital gains, bunching deductions on Donor Advised Funds, end of year equipment or vehicle purchases, and maximizing retirement plan contributions. TRANSCRIPT: I’m Cary Stamp and…

Read MoreThanksgiving is About Family

We established a tradition that ensures we enjoy both sides of our family at Thanksgiving. A few years ago, I began a tradition with my family of celebrating Thanksgiving two to three weeks before the actual holiday. This wasn’t an original idea, as another family that I knew also had been participating in this tradition…

Read More- « Previous

- 1

- 2

- 3

- 4

- Next »