Would You Give Your House Away? You Might Like To with a Qualified Personal Residence Trust.

Forbes Best-In-State wealth advisor Cary Stamp thinks it’s time for you to learn about a sophisticated and little-known estate planning strategy called the Qualified Personal Residence Trust (QPRT). There aren’t many reasons to literally give your house away — in fact this may be the only one! VIDEO TRANSCRIPT: Hi, I’m Cary Stamp, I’m a Certified Financial Planner and I’m an Accredited Estate Planner and I’m going to tell you today why you might want to give your house away.…

READ MORE ⟶Donor Advised Funds are Exploding in Popularity in Charitable Giving. Here’s Why!

Cary Stamp, CFP® in Jupiter, FL describes the considerable tax and administrative benefits of using a Donor Advised Fund for charitable giving. Mr. Stamp is a Forbes Best-In-State wealth advisor. VIDEO TRANSCRIPT: I’m Certified Financial Planner, Cary Stamp. I’m also a Chartered Advisor in Philanthropy, and over the last three years, we’ve helped our clients’ families give away almost $2 million to charities of their choice. One of the main ways that we’re doing this is by using a strategy…

READ MORE ⟶My Mission to Improve Financial Advisor Competence

Most financial “advisors” receive minimal training and while many eventually end up becoming competent, they leave damage behind in the process. Our new clients often wonder why I might have a couple of extra team-members in one of our meetings. The extra cast will be sitting quietly, taking notes. The answer is that I am on a mission to improve financial advisor competence. I know that someday I will either retire or exit this world and I have an obligation…

READ MORE ⟶Turning Lemons Into Lemonade! Three Strategies to Consider During a Market Downturn.

When the markets give you a correction, it’s time to turn lemons into lemonade. Forbes Best-In-State Financial Advisor Cary Stamp of Jupiter, FL offers three strategies that you should consider during a market downturn. NOTES: Converting from a traditional IRA to a Roth IRA is a taxable event. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Commonwealth Financial Network® nor any of its representatives may give legal or tax advice.…

READ MORE ⟶Inc. Magazine Reveals Cary Stamp & Co.’s Premier on the Inc. 5000 List

NEW YORK, August 17, 2021 – Inc. magazine today revealed that Cary Stamp & Co., the Principled Wealth Advisors™ based in Palm Beach County, FL, has premiered at No. 4689 on its annual Inc. 5000 list, the most prestigious ranking of the nation’s fastest-growing private companies. The list represents a unique look at the most successful companies within the American economy’s most dynamic segment—its independent small businesses. Intuit, Zappos, Under Armour, Microsoft, Patagonia, and many other well-known names gained their…

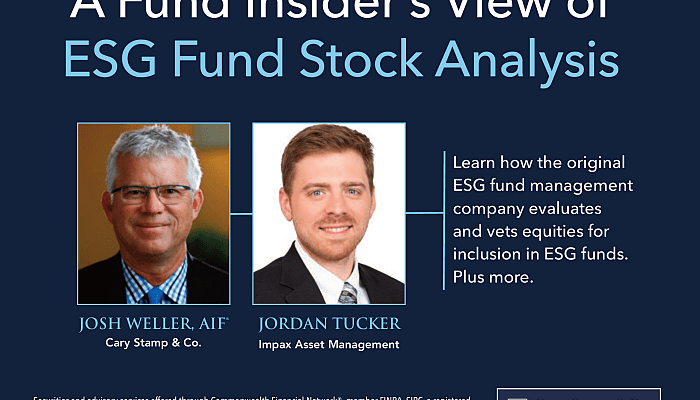

READ MORE ⟶A Mutual Fund Insider’s View of ESG Stock Analysis

A brief conversation with financial advisor and ESG specialist Josh Weller, AIF® and Jordan Tucker of Impax Asset Management https://youtube.com/watch?v=qY1ydaeEnvg Jordan Tucker of Impax Asset Management and PAX funds joins Josh Weller AIF® for a topical discussion about how Impax and PAX World Funds evaluate equities for inclusion in ESG funds. This is a subject of recent debate in the investing world and provides an insider’s look into the painstaking due diligence process pursued by ESG-focused fund companies. At the…

READ MORE ⟶Marching Into A Season Of Giving!

This March, through our program Cary Stamp Cares, we were fortunate enough to be a part of three fantastic charity events. On March 3rd, a few lucky members of our office were able to attend the 2nd annual Golf and Give, an event created by the group Suits for Seniors. This group, headed by founder and CEO Jervonte “Tae” Edmonds, focuses on providing at-risk high school seniors with an eight-week mentorship program that focuses on teaching leadership, finance, and interpersonal…

READ MORE ⟶Why that Roth IRA Conversion You Were Considering May be Even More Valuable

Current Tax Discussions in Congress May Lead to Drastic Changes in Estate Tax Exemptions that Increase the Value of a Roth IRA Conversion Strategy. For years, I’ve been stressing the benefits of Roth IRAs to our clients and their beneficiaries. In an environment of massive government spending and a constantly greater need to pay for social programs, what could be better than an investment account in which you can purchase virtually anything you like, leave it for as long as…

READ MORE ⟶Cary’s Market Commentary – March 2021

From an investment standpoint, 2020 can be considered nothing short of remarkable. The markets started the year feeling tailwinds from a strong economy and almost full employment. Of course, the reaction to the pandemic we saw in March resulted in a violent pullback that left us feeling uncertain and unsettled. The idea that we would put those losses in the rear-view mirror and soon watch the markets move on to make new highs was not even on the radar screen. In my October message,…

READ MORE ⟶Cary Stamp, Founder of Cary Stamp & Co. , Named on Forbes Best-In-State Wealth Advisors List for 2021

Stamp joins the Forbes Best-In-State list spotlighting the top regional financial advisors throughout the country. Cary Stamp & Co., a provider of financial advisory services based Palm Beach County, FL, announced that founder Cary Stamp has been named on Forbes Best-In-State Wealth Advisors for 2021 list for South Florida. The list is published online at: https://www.forbes.com/best-in-state-wealth-advisors. According to Forbes, a leading U.S. financial publication, the list spotlights more than 4,000 top financial advisors across the country who were nominated by their firms—and then researched, interviewed and…

READ MORE ⟶How to Integrate ESG and Sustainable Fund Choices into 401(k) and Other Retirement Plans

Josh Weller on ESG in 401k Plans: Financial advisor Josh Weller, based in Palm Beach County, FL and specializing in Sustainable-ESG Investing, discusses the important subject of offering ESG fund choices in 401(k) plans. With the backdrop of climate change, social responsibility issues, the corporate sustainability movement, and the huge asset flow into ESG, if employers don’t act now, when will they? The process is manageable, fulfilling, and in alignment with corporate sustainability and human resources missions—without sacrificing performance. WATCH…

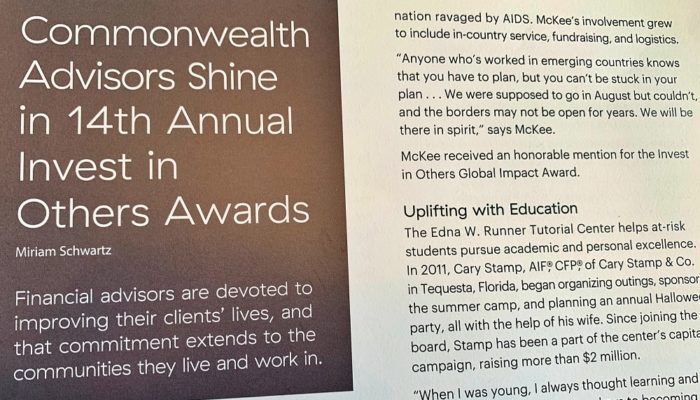

READ MORE ⟶Cary Stamp Recognized by National Charitable Foundation for Philanthropic Work

Cary is one of four Commonwealth Financial advisors in U.S. to be recognized nationally by the Invest in Others Charitable Foundation. The Edna W. Runner Tutorial Center in West Jupiter, FL helps at-risk students pursue academic and personal excellence. For more than eight years, Cary Stamp, AIF®, CFP®, has been a member of the Board of Directors—organizing outings, sponsoring the summer camp, and planning an annual Halloween Party, with the help of his wife Sharon. Since joining the board, and serving…

READ MORE ⟶How Families that Need Life Insurance Get the Right Policy for the Right Price

An Unbiased, Independent Source for the Best Life Insurance Policy at the Right Price. Many people need proper life insurance to protect their family or provide liquidity for their estate, and you have many choices. Learn why clients like having our team by their side, from Palm Beach County financial advisor Cary Stamp, CFP®. TRANSCRIPT: Hi, my name is Cary Stamp, I’m the founder of Cary Stamp & Company. A lot of our clients ask us if…

READ MORE ⟶When You Do Better, We Do Better — How Financial Advisors are Paid.

Cary Stamp, CFP®, Jupiter, Florida-based financial advisor, addresses a question that you should ask any financial professional that you consider working with: How is your financial advisor paid? In the case of Cary Stamp & Co., when you do better, we do better. Our transparent fee structure mutually aligns our interests with yours. Always make sure that your financial advisor’s best interests align with your best interests. TRANSCRIPT: Hi, I’m Cary Stamp with Cary Stamp & Company. I want…

READ MORE ⟶The Power and Flexibility of the Roth IRA

Josh takes a break from Sustainable Investing to describe the primary differences between the Traditional and Roth IRA. The focus is on the benefits and flexibility of the Roth IRA—possibly the most powerful retirement planning tool for most investors. TRANSCRIPT: Hey, it’s Josh Weller here. It’s Roth IRA Awareness Month at Cary Stamp & Company, so I’m diverting my focus away from Sustainable Investing just for a little while, to focus on a Roth IRA and why I think it…

READ MORE ⟶How to Lower Your Taxes in Retirement with Roth IRA Conversions

Leading financial advisor based in Jupiter, FL, Cary Stamp, CFP®, shares the Roth IRA conversion strategy that many people are unaware of, but can make a huge difference on taxable income in retirement. This is especially important if you’re within a few years of retirement or if you’re in that gap between the time that you’ve retired and the time that you plan to turn on your Social Security payments to generate income. TRANSCRIPT: Hi, I’m Cary Stamp, and this…

READ MORE ⟶Roth IRAs for Beginners

Roth IRAs are a Crucial Tool for Lowering Taxes in Retirement. Roth IRAs are after-tax retirement accounts, in contrast to traditional IRAs and most employer-sponsored retirement plans such as 401(k) programs that are tax-deferred accounts (pre-tax contributions). Because of the unique tax structure, Roth IRAs have several advantages. First, what is an IRA? IRA is the acronym for Individual Retirement Account. An IRA is a tax-advantaged investment account designed to help Americans save for retirement. Money invested within a Traditional IRA grows over…

READ MORE ⟶Three Investment Books That Impacted My Financial Career

Financial advisor Cary Stamp shares a brief overview of the three investing books that had a major impact on his investment management and financial advisory career. TRANSCRIPT: I’m Cary Stamp with Cary Stamp & Company, Principled Wealth Advisors. I want to share with you three books that have had a major impact on my investing career. The first one is this one. It’s a little tiny red book. It’s called The Little Book of Common Sense Investing…

READ MORE ⟶My Personal Secret and How It Can Help You Financially

Financial advisor Cary Stamp shares an uncomfortable secret that can help you recover from financial adversity or a mistake that you feel vulnerable or embarrassed about. Don’t be afraid to admit your mistake and seek the assistance of a financial advisor to get back on track. TRANSCRIPT: Recovering from Financial Adversity My name is Cary Stamp and I’m the founder of Cary Stamp & Co., Principled Wealth Advisors, and I wanted to let you in on a…

READ MORE ⟶A Great Solution After The Secure Act’s Elimination of the “Stretch IRA”

The Secure Act eliminated the Stretch IRA option for beneficiaries to distribute inherited IRAs over their lifetimes. Now there’s a 10-year distribution maximum. If you’re close to retirement, have a lot of money in retirement plans, and want to maximize assets passed on to beneficiaries when you’re no longer here, there’s a great solution. TRANSCRIPT: My name is Cary Stamp, and this is a Principled Wealth Moment. I’d like to talk about The Secure Act and one of the…

READ MORE ⟶