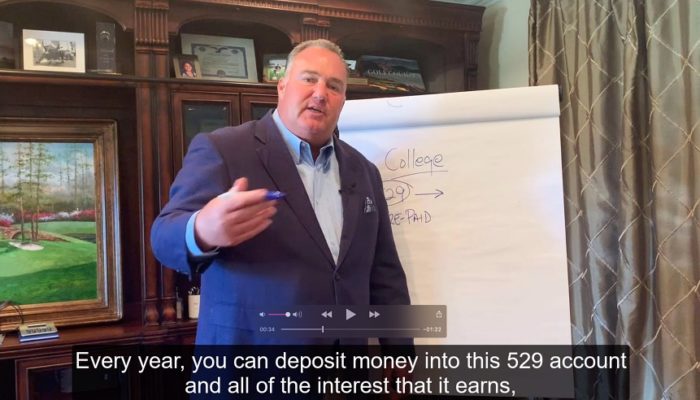

Saving for Family Education Expenses with Tax-Advantaged 529 Plans

Financial advisor Cary Stamp, based in Jupiter, FL, discusses the ability to maximize savings for family education expenses while reducing your income taxes, using 529 Plans. Tax-free distributions from these plans can be used for elementary and secondary private school, and undergrad and graduate college. TRANSCRIPT: I’m Cary Stamp, and this is a Principled Wealth Moment. I’m going to share a strategy that you can use to maximize your savings for college and reduce your income taxes. It’s called…

READ MORE ⟶Managing Investments During Recessions and Market Declines

Cary Stamp, leading financial advisor based in Jupiter, FL, shares his view on how individuals and families should approach investment management during recessions and market declines. TRANSCRIPT: Hi, I’m Cary Stamp. I’ve gotten a lot of questions lately about what’s going on in the markets and what’s happening in the US economy. And I wanted to share a couple of thoughts because I believe that it’s going to be a long, hard slog and it’s not going to…

READ MORE ⟶Think: Time in the Market, not Timing the Market

Leading financial advisor Cary Stamp comments briefly on why timing the stock market is so difficult, and why letting assets grow long-term (“time in the market”) is the path to wealth creation. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. I’d like to talk today about the subject of market timing. A lot of people are worried right now. Is the market high? Should I be getting out? Should I sell everything and sit on…

READ MORE ⟶Beneficial CARES Act Provisions for 401k and IRA Accounts

Cary Stamp, leading financial advisor based in Jupiter, FL, provides an update on beneficial CARES Act provisions for retirement accounts—including IRAs and 401(k)s—to help with the financial challenges of the COVID-19 crisis. TRANSCRIPT: Hi, I’m Cary Stamp. This is a Principled Wealth Moment. I would like to share with you some updates regarding retirement plans and what you’re able to do with them. This is new information that comes from the CARES Act passed within the last…

READ MORE ⟶Client Market Update – May 2020

Leading financial advisor Cary Stamp delivers his Market Update for early May 2020. He shares some thoughts from Scott Minerd of Guggenheim Partners, as well as his own view of proper risk management within the new normal of market volatility. TRANSCRIPT: Hi. Most of you know that I’m Cary Stamp and I’m a certified financial planner. I want to share some thoughts with you and with the rest of my clients about where we see things going. There…

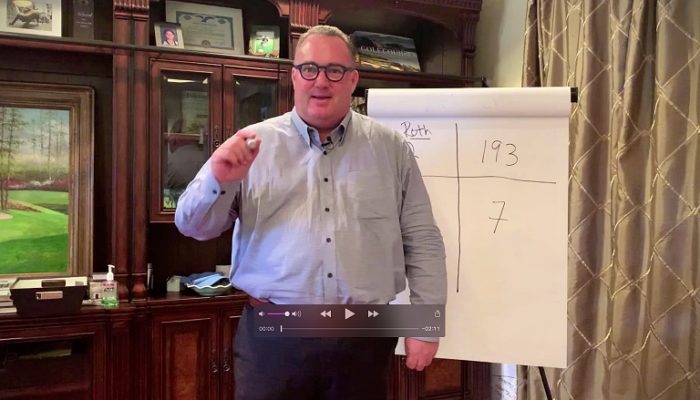

READ MORE ⟶How To Do the Back Door Roth IRA

Cary Stamp, leading financial advisor based in Jupiter, FL, offers a quick description of the Back Door Roth IRA strategy, which is the method for contributing to a Roth IRA even if you earn too much income. TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment, and today I’m going to explain to you how you can make a Roth IRA even if you make too much money to make a Roth IRA contribution. It’s really…

READ MORE ⟶A Time for Gratitude and Patience

Leading financial advisor Cary Stamp puts the Coronavirus crisis and market decline into perspective, discussing the need for patience and gratitude in getting to the other side. TRANSCRIPT: Hi, I’m Cary Stamp. This is a Principled Wealth Moment. I wanted to address one more time what’s going on during the Coronavirus lockdown. As we sit at our homes and very few of us in our offices and think about what’s going on, I think that it’s incumbent upon us…

READ MORE ⟶How Much Life Insurance Do You Need?

Cary Stamp, leading financial advisor based in Jupiter, FL, provides perspective on the proper amount of life insurance and the question of whether your beneficiaries would need to use the principal of life insurance proceeds for living expenses. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. I just read a statistic that talked about life insurance applications. And last week, in the midst of the health scare that we’re going through right now, insurance…

READ MORE ⟶Summary of State & Federal Financial Responses to COVID-19 Crisis

UPDATED SUN. MARCH 29, 2020 In the interest of keeping clients, friends, and our communities informed, we have created a list of financial-related responses by State and Federal governments to the current crisis. Updates to come as new information becomes available. FEDERAL ANNOUNCEMENTS The CARES Act ($2.2 trillion) The largest fiscal stimulus in American history Individuals with up to $75,000 in adjusted gross income in 2019 will receive a onetime payment of $1,200. Married couples with AGI up to $150,000…

READ MORE ⟶Taking Advantage of Opportunities for Long-Term Wealth Creation

Cary Stamp—leading Jupiter, FL financial advisor—calls upon decades of experience to offer his view that the Covid-19 crisis may be a generational opportunity for long-term wealth creation. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. And I’d like you to listen to something. [knock knock knock] Do you hear that sound? That’s opportunity knocking. Let me explain. I think at this particular moment, we’re in one of the greatest opportunities for wealth creation that…

READ MORE ⟶3 Investment Management Strategies for a Down Market

Leading financial advisor Cary Stamp offers three potentially profitable investment strategies for market declines. Tax Loss Harvesting, Roth IRA Conversions, and Buying Low with Dollar Cost Averaging. TRANSCRIPT: Hi, I’m Cary Stamp, this is a Principled Wealth Moment. Nobody likes a down market, but I’m going to explain how we can profit, or at least set ourselves up in a better position, when equity markets go down. Life gives us these lemons, here’s the recipe for…

READ MORE ⟶The Power of Now — A More Fulfilling Approach to Planned Giving

Highly-Rated Sustainable-ESG Assets Offer the Comfort of Having a Constant Positive Impact. The purpose of creating a Planned Giving strategy at any level of wealth is to formalize, in a tax-efficient manner, your desire to give back to the entities and causes that are close to your heart. It’s a noble process that has positive impact; but it can feel unfulfilling in quiet months between gifts, depending on how the giving strategy has been structured. Many folks who have enacted…

READ MORE ⟶The Importance of Making a Difference in Your Community

Cary Stamp, leading financial advisor in Jupiter, FL, shares his perspective on making a difference in the world by giving back to local community organizations. TRANSCRIPT: I grew up in Iowa and growing up in Iowa was pretty average. I went to a public school, I got pretty good grades and I gravitated towards being on the debate team. People told me I had a gift for gab. So I ended up going to tournaments all…

READ MORE ⟶Phenomenal Tax Credits up to $5,000 per year for Launching a New 401(k) Plan

Leading financial advisor Cary Stamp, based in Jupiter, FL, offers an overview of the exceptional tax credits up to $5,000 per year for businesses that launch new 401k plans (made available through a Secure Act provision). TRANSCRIPT: Hi, I’m Cary Samp with Cary Stamp & Co., and this is a Principled Wealth Moment for business owners or anybody that works in a business. I’ve got a tip that most people don’t know about, that’s a phenomenal opportunity.…

READ MORE ⟶Asset Allocation, not Stock Picking, May Have More Impact on Your Portfolio’s Success

Asset Allocation and Portfolio Success: 90% of an Investment Portfolio’s Returns May Result from Proper Asset Allocation, not Stock Picking A 2000 study by economists Roger Ibbotson and Paul Kaplan concluded that more than 90% of a portfolio’s long-term returns may be driven by its asset allocation. For starters, what exactly is “Strategic Asset Allocation” Asset allocation is an investment strategy that involves selecting a mix of investments that are appropriate for a person’s risk tolerance, time horizon, and financial…

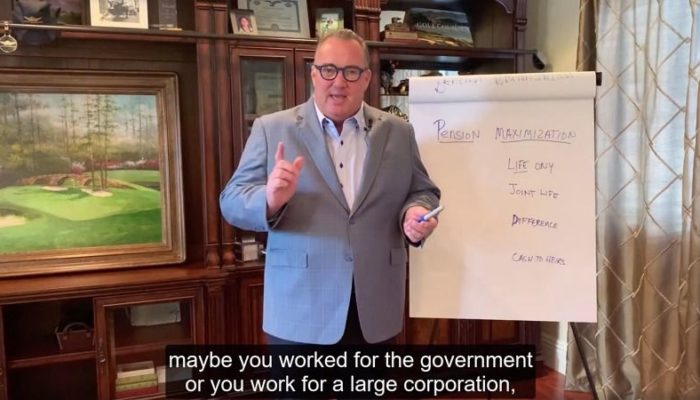

READ MORE ⟶Maximize Your Pension with a Huge Lump Sum Passed on to Beneficiaries

Jupiter, FL financial advisor Cary Stamp briefly outlines an innovative Pension Maximization strategy that can add a huge lump sum to the assets you pass on to beneficiaries. TRANSCRIPT: I am Cary Stamp with Cary Stamp and Company. This is a Principled Wealth Moment. And if you’re somebody that has a pension, maybe you worked for the government or you work for a large corporation, then I’m talking to you today. And the reason I’m talking to you is…

READ MORE ⟶How to Maximize Contributions and Tax Deductions to a Solo 401(k)

Leading financial advisor Cary Stamp provides a quick lesson on how entrepreneurs such as attorneys and real estate agents with 1099 income can maximize contributions to what’s known as a Solo or Individual 401(k). TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment. Today, I’m going to explain to you how you can establish a retirement plan for your small business when you have no employees and put a bunch of money away for your retirement.…

READ MORE ⟶When to Take and How to Maximize Social Security Benefits

In this video, Cary Stamp, leading investment and financial advisor based in the Jupiter, FL area, briefly addresses one of the most common question asked of financial advisors: “When should people start taking social security benefits?”. TRANSCRIPT: Hi, I’m Cary Stamp. This is a Principled Wealth Moment. Today I’m going to talk about one of the most common questions that we get as financial advisors, and that question is very simple: when should you take your social security?…

READ MORE ⟶Debunking the Big Myth About Sustainable/ESG Investing

Today, we dispel the decades-old myth that performance must be sacrificed when investing responsibly in Sustainable/ESG assets. This myth rises again and again like Freddy Krueger in a horror movie, and, like Freddy, the myth should be laid to rest. Sustainable ESG Investing Performance Below, we share four graphs comparing the performance of broad indexes vs the same indexes filtered through an ESG screen. Based on the 5-year index performance comparisons, we see that ESG index performance is in line…

READ MORE ⟶Hybrid Long-Term Care Insurance Combines Long-Term Care Benefits and Life Insurance in One Policy

Financial advisor Cary Stamp discusses the value of Hybrid Long Term Care Insurance, a powerful combination of Long Term Care Benefits with Life Insurance that preserves your capital. TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment. Today I’m going to talk about a subject that most people really don’t like to address. I’m going to talk about how you pay for long term care expenses for yourself or maybe for a loved one. So, I…

READ MORE ⟶