Asset Allocation and Portfolio Success: 90% of an Investment Portfolio’s Returns May Result from Proper Asset Allocation, not Stock Picking

A 2000 study by economists Roger Ibbotson and Paul Kaplan concluded that more than 90% of a portfolio’s long-term returns may be driven by its asset allocation.

A 2000 study by economists Roger Ibbotson and Paul Kaplan concluded that more than 90% of a portfolio’s long-term returns may be driven by its asset allocation.

For starters, what exactly is “Strategic Asset Allocation”

Asset allocation is an investment strategy that involves selecting a mix of investments that are appropriate for a person’s risk tolerance, time horizon, and financial goals.

The most common types of broad asset allocation classes are equities (stocks and ETF’s), fixed income (bonds), and cash and cash equivalents (liquid cash and money market deposit accounts).

Each asset class is expected to have different risk and return characteristics, so each will behave differently based on market conditions. Stocks are generally more aggressive than fixed income and have the potential for higher returns over time. Fixed income/bonds are a safer investment, for many reasons, that provide interest income and potential growth depending on the asset used.

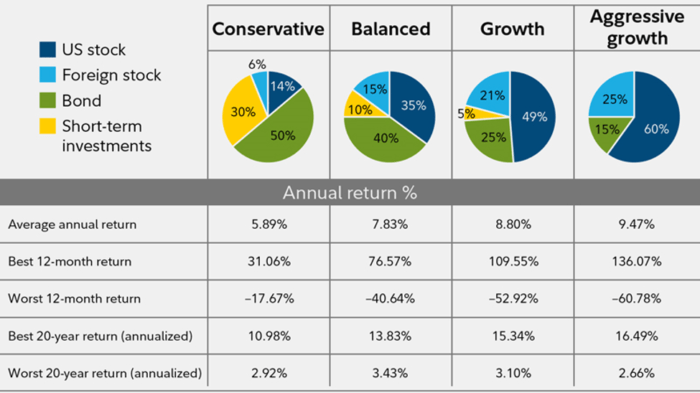

Sample Asset Allocations for Different Stages in Life:

Data source: Morningstar Inc., 2019 (1926–2018). Past performance is no guarantee of future results. Returns include the reinvestment of dividends and other earnings. This chart is for illustrative purposes only and does not represent actual or implied performance of any investment option.

What is the Best Asset Allocation for You?

Usually, Investors who do not expect to retire for decades should be growth-oriented and allocate more of their portfolio to equities over fixed income and cash equivalents. On the other hand, investors approaching retirement who know they will need to start taking retirement fund withdrawals relatively soon should be more conservative with larger allocations to fixed income and cash equivalents, smaller to equities.

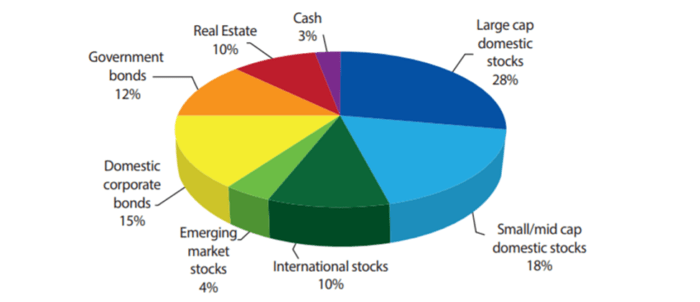

Portfolios should be further diversified by selecting a range of asset types within the broader allocations (sample below). This is accomplished by selecting assets based in different regions around the world, industries, or investment “styles.”

Sample of Diversified Asset Allocation (Sectors/Asset Classes):

It’s advisable to consult with a trusted CERTIFIED FINANCIAL PLANNER™ professional when creating your portfolio’s asset allocation, and to continue reviewing regularly over time as your life evolves and market conditions change.

More on the asset allocation research and ensuing studies

Asset allocation programs do not assure a profit or protect against loss in declining markets. No program can guarantee that any objective or goal will be achieved.