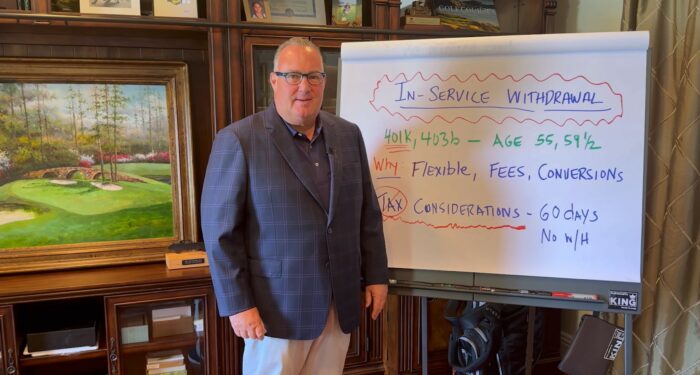

Learn how to gain more control over your retirement planning with the little-known but powerful in-service withdrawal strategy! Cary Stamp shares insights on how you can utilize this technique to unlock a world of investment possibilities, reduce fees, and even convert traditional retirement funds to tax-free Roth IRA accounts. Watch now and take charge of…

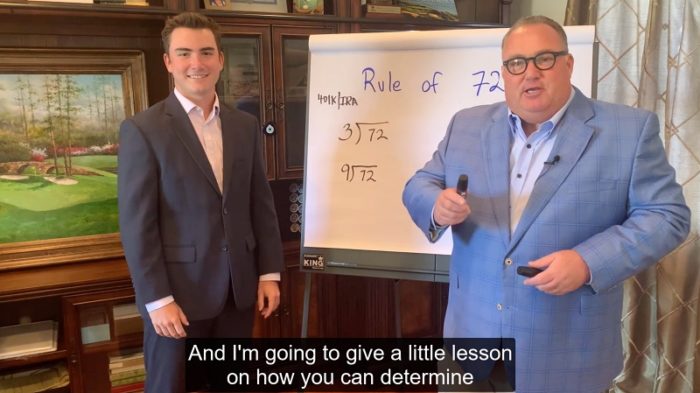

READ MORE ⟶The Rule of 72 is a simple arithmetical equation approximating how long to double your investment at an annual rate of return. In this video, Cary Stamp, CFP® and financial analyst Austin Kuyrkendall explain the power of investing your assets over the long term at a higher rate of return, using the Rule of 72.…

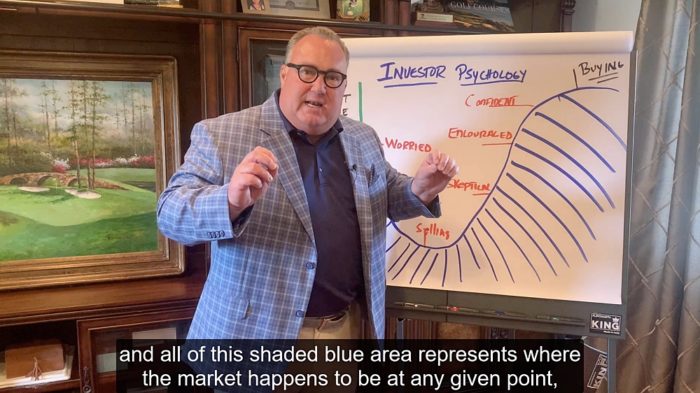

READ MORE ⟶We’ve all heard the old stock market adage “Buy Low, Sell High.” But it’s easier said than done. Investor psychology during corrections can play tricks with the mind and this leads many people to sell low and buy high. In this video, Cary Stamp, CFP®, a Forbes Best-In-State Financial Advisor, explains the nature of investor…

READ MORE ⟶When the markets give you a correction, it’s time to turn lemons into lemonade. Forbes Best-In-State Financial Advisor Cary Stamp of Jupiter, FL offers three strategies that you should consider during a market downturn. NOTES: Converting from a traditional IRA to a Roth IRA is a taxable event. For a comprehensive review of your…

READ MORE ⟶From an investment standpoint, 2020 can be considered nothing short of remarkable. The markets started the year feeling tailwinds from a strong economy and almost full employment. Of course, the reaction to the pandemic we saw in March resulted in a violent pullback that left us feeling uncertain and unsettled. The idea that we would put those losses in…

READ MORE ⟶Financial advisor Cary Stamp shares a brief overview of the three investing books that had a major impact on his investment management and financial advisory career. TRANSCRIPT: I’m Cary Stamp with Cary Stamp & Company, Principled Wealth Advisors. I want to share with you three books that have had a major impact…

READ MORE ⟶Financial advisor Cary Stamp shares an uncomfortable secret that can help you recover from financial adversity or a mistake that you feel vulnerable or embarrassed about. Don’t be afraid to admit your mistake and seek the assistance of a financial advisor to get back on track. TRANSCRIPT: Recovering from Financial Adversity My…

READ MORE ⟶Cary Stamp, leading financial advisor based in Jupiter, FL, shares his view on how individuals and families should approach investment management during recessions and market declines. TRANSCRIPT: Hi, I’m Cary Stamp. I’ve gotten a lot of questions lately about what’s going on in the markets and what’s happening in the US economy. And…

READ MORE ⟶Leading financial advisor Cary Stamp comments briefly on why timing the stock market is so difficult, and why letting assets grow long-term (“time in the market”) is the path to wealth creation. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. I’d like to talk today about the subject of market…

READ MORE ⟶Leading financial advisor Cary Stamp delivers his Market Update for early May 2020. He shares some thoughts from Scott Minerd of Guggenheim Partners, as well as his own view of proper risk management within the new normal of market volatility. TRANSCRIPT: Hi. Most of you know that I’m Cary Stamp and I’m a…

READ MORE ⟶