Cary Stamp, CFP®, Jupiter, Florida-based financial advisor, addresses a question that you should ask any financial professional that you consider working with: How is your financial advisor paid? In the case of Cary Stamp & Co., when you do better, we do better. Our transparent fee structure mutually aligns our interests with yours. Always make…

READ MORE ⟶Leading financial advisor based in Jupiter, FL, Cary Stamp, CFP®, shares the Roth IRA conversion strategy that many people are unaware of, but can make a huge difference on taxable income in retirement. This is especially important if you’re within a few years of retirement or if you’re in that gap between the time that…

READ MORE ⟶Financial advisor Cary Stamp shares a brief overview of the three investing books that had a major impact on his investment management and financial advisory career. TRANSCRIPT: I’m Cary Stamp with Cary Stamp & Company, Principled Wealth Advisors. I want to share with you three books that have had a major impact…

READ MORE ⟶Financial advisor Cary Stamp shares an uncomfortable secret that can help you recover from financial adversity or a mistake that you feel vulnerable or embarrassed about. Don’t be afraid to admit your mistake and seek the assistance of a financial advisor to get back on track. TRANSCRIPT: Recovering from Financial Adversity My…

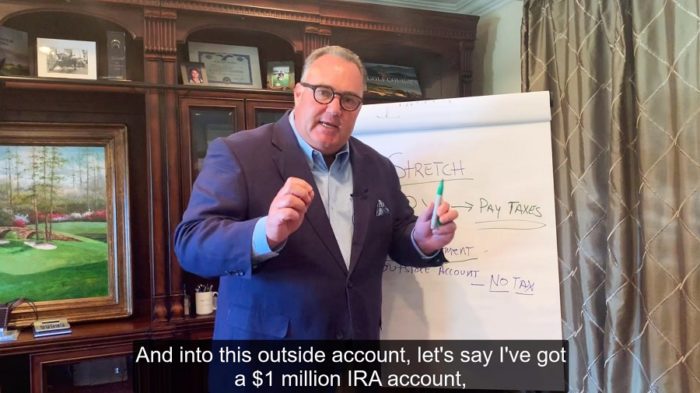

READ MORE ⟶The Secure Act eliminated the Stretch IRA option for beneficiaries to distribute inherited IRAs over their lifetimes. Now there’s a 10-year distribution maximum. If you’re close to retirement, have a lot of money in retirement plans, and want to maximize assets passed on to beneficiaries when you’re no longer here, there’s a great solution. …

READ MORE ⟶Financial advisor Cary Stamp, based in Jupiter, FL, discusses the ability to maximize savings for family education expenses while reducing your income taxes, using 529 Plans. Tax-free distributions from these plans can be used for elementary and secondary private school, and undergrad and graduate college. TRANSCRIPT: I’m Cary Stamp, and this is a Principled…

READ MORE ⟶Cary Stamp, leading financial advisor based in Jupiter, FL, shares his view on how individuals and families should approach investment management during recessions and market declines. TRANSCRIPT: Hi, I’m Cary Stamp. I’ve gotten a lot of questions lately about what’s going on in the markets and what’s happening in the US economy. And…

READ MORE ⟶Leading financial advisor Cary Stamp comments briefly on why timing the stock market is so difficult, and why letting assets grow long-term (“time in the market”) is the path to wealth creation. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. I’d like to talk today about the subject of market…

READ MORE ⟶Cary Stamp, leading financial advisor based in Jupiter, FL, provides an update on beneficial CARES Act provisions for retirement accounts—including IRAs and 401(k)s—to help with the financial challenges of the COVID-19 crisis. TRANSCRIPT: Hi, I’m Cary Stamp. This is a Principled Wealth Moment. I would like to share with you some updates…

READ MORE ⟶Leading financial advisor Cary Stamp delivers his Market Update for early May 2020. He shares some thoughts from Scott Minerd of Guggenheim Partners, as well as his own view of proper risk management within the new normal of market volatility. TRANSCRIPT: Hi. Most of you know that I’m Cary Stamp and I’m a…

READ MORE ⟶