Financial advisor Cary Stamp, based in Jupiter, FL, discusses the ability to maximize savings for family education expenses while reducing your income taxes, using 529 Plans. Tax-free distributions from these plans can be used for elementary and secondary private school, and undergrad and graduate college. TRANSCRIPT: I’m Cary Stamp, and this is a Principled…

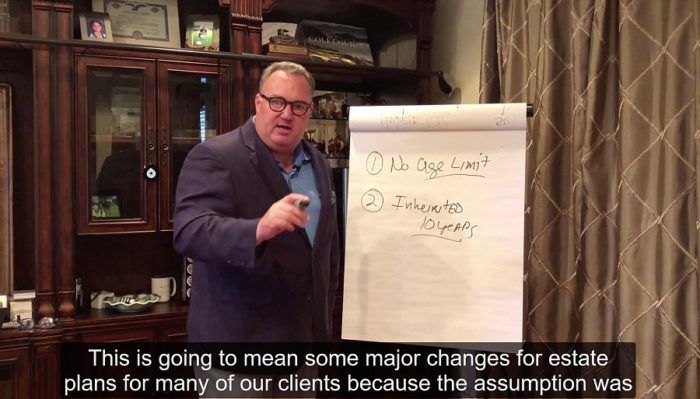

READ MORE ⟶What’s in the Secure Act? Financial advisor Cary Stamp addresses the four primary ways the recently passed Secure Act will affect individuals and families, most notably on Individual Retirement Accounts (IRAs) and 529 Education Plans. TRANSCRIPT: What’s in the Secure Act? I’m Cary Stamp. This is a principled wealth moment. Welcome to…

READ MORE ⟶The cost of college tuition continues to increase every year with most college planning experts projecting a 6% annual increase each year. One might ask, “How do I save for my child’s college education if I cannot even afford the costs now, let alone in the future when my child enters college?” In previous generations,…

READ MORE ⟶