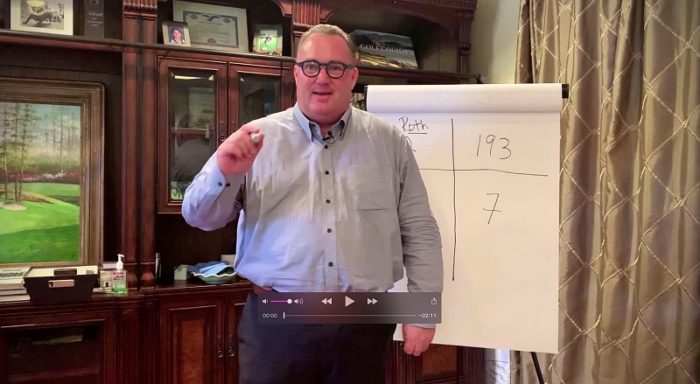

Josh takes a break from Sustainable Investing to describe the primary differences between the Traditional and Roth IRA. The focus is on the benefits and flexibility of the Roth IRA—possibly the most powerful retirement planning tool for most investors. TRANSCRIPT: Hey, it’s Josh Weller here. It’s Roth IRA Awareness Month at Cary Stamp & Company,…

READ MORE ⟶Leading financial advisor based in Jupiter, FL, Cary Stamp, CFP®, shares the Roth IRA conversion strategy that many people are unaware of, but can make a huge difference on taxable income in retirement. This is especially important if you’re within a few years of retirement or if you’re in that gap between the time that…

READ MORE ⟶Roth IRAs are a Crucial Tool for Lowering Taxes in Retirement. Roth IRAs are after-tax retirement accounts, in contrast to traditional IRAs and most employer-sponsored retirement plans such as 401(k) programs that are tax-deferred accounts (pre-tax contributions). Because of the unique tax structure, Roth IRAs have several advantages. First, what is an IRA? IRA is…

READ MORE ⟶Cary Stamp, leading financial advisor based in Jupiter, FL, offers a quick description of the Back Door Roth IRA strategy, which is the method for contributing to a Roth IRA even if you earn too much income. TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment, and today I’m going to…

READ MORE ⟶Cary Stamp—leading Jupiter, FL financial advisor—calls upon decades of experience to offer his view that the Covid-19 crisis may be a generational opportunity for long-term wealth creation. TRANSCRIPT: Hi, I’m Cary Stamp, and this is a Principled Wealth Moment. And I’d like you to listen to something. [knock knock knock] Do you hear…

READ MORE ⟶Leading financial advisor Cary Stamp provides a quick lesson on how entrepreneurs such as attorneys and real estate agents with 1099 income can maximize contributions to what’s known as a Solo or Individual 401(k). TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment. Today, I’m going to explain to you how…

READ MORE ⟶Financial advisor Cary Stamp discusses the value of Hybrid Long Term Care Insurance, a powerful combination of Long Term Care Benefits with Life Insurance that preserves your capital. TRANSCRIPT: I’m Cary Stamp and this is a Principled Wealth Moment. Today I’m going to talk about a subject that most people really don’t like…

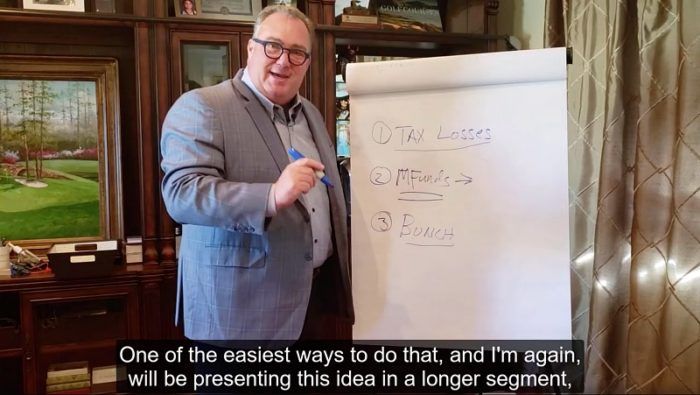

READ MORE ⟶Leading financial advisor Cary Stamp, CFP® provides five year-end tax planning ideas: three for individuals, and two for businesses. Ideas include tax loss selling, avoiding high mutual fund capital gains, bunching deductions on Donor Advised Funds, end of year equipment or vehicle purchases, and maximizing retirement plan contributions. TRANSCRIPT: I’m Cary Stamp and…

READ MORE ⟶Each year at this time, I reflect on the year past and create my vision for the next revolution around the sun. Usually, I am having this conversation with myself at the conclusion of our year-end travels and I have some quiet time to think. This year, I am doing my thinking in Lima, Peru.…

READ MORE ⟶