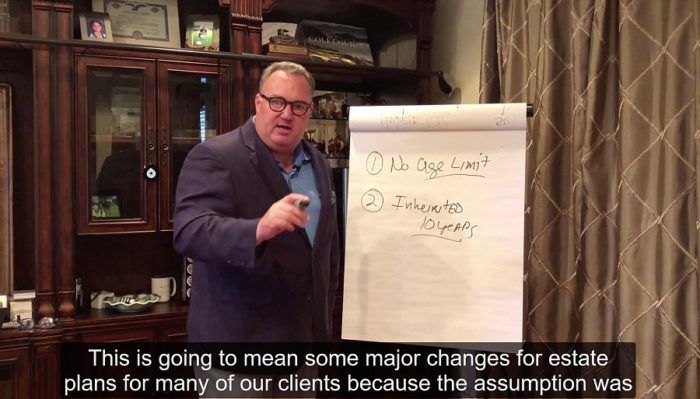

What’s in the Secure Act? Financial advisor Cary Stamp addresses the four primary ways the recently passed Secure Act will affect individuals and families, most notably on Individual Retirement Accounts (IRAs) and 529 Education Plans. TRANSCRIPT: What’s in the Secure Act? I’m Cary Stamp. This is a principled wealth moment. Welcome to…

READ MORE ⟶Leading financial advisor Cary Stamp, CFP® discusses the tax efficiency benefits of Donor Advised Fund bunching deductions. TRANSCRIPT: Today I’d like to talk about how we can make the world a better place, and get some tax deductions all at the same time. And it’s by using a strategy that we call “Bunching Deductions.”…

READ MORE ⟶I was given a new nickname this week. “Pops!” I became a grandfather. In response, I immediately let my imagination run wild and scoured the web for “tiny baseball mitts” and “really small golf clubs,” but my practical side reappeared and I thought: “what would be the most prudent action for a grandfather to take…

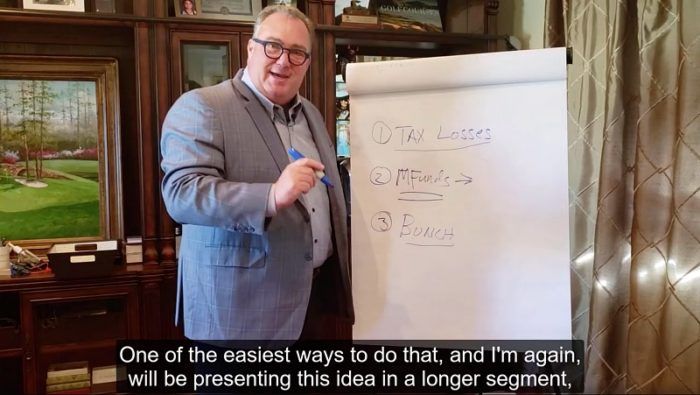

READ MORE ⟶Leading financial advisor Cary Stamp, CFP® provides five year-end tax planning ideas: three for individuals, and two for businesses. Ideas include tax loss selling, avoiding high mutual fund capital gains, bunching deductions on Donor Advised Funds, end of year equipment or vehicle purchases, and maximizing retirement plan contributions. TRANSCRIPT: I’m Cary Stamp and…

READ MORE ⟶An Introduction to Estate Planning Strategies Do you have a will or estate plan? Many individuals and families overlook the need for estate planning in the belief that if they don’t possess significant wealth or a complicated situation, a plan is not required. At Cary Stamp & Co., we believe every individual and family should…

READ MORE ⟶