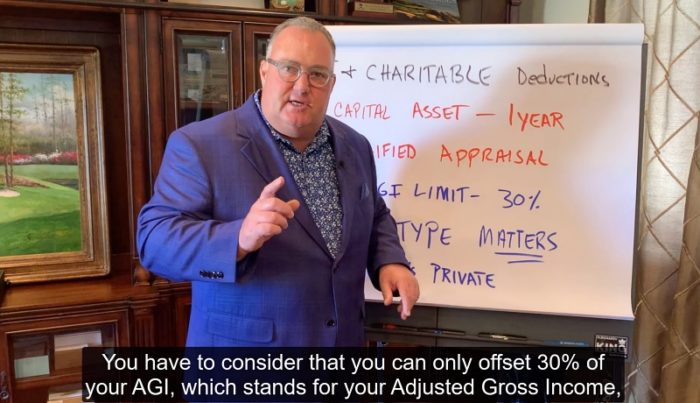

Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP®, combines his passion for fine art with decades of financial knowledge to share key issues involved in donating fine art to charities. There are some details that make all the difference. TRANSCRIPT: One of my passions is the art world and understanding art. And I like to couple…

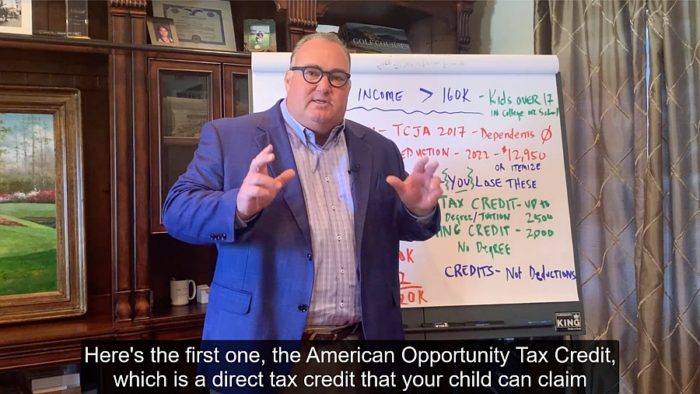

READ MORE ⟶Tax Credits for College-Aged Kids You may be making a mistake if your kids are college-age and you’re not taking advantage of the American Opportunity Tax Credit and Lifetime Learning Credit. In this video, Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP®, provides an overview of these two significant tax credits available to families with more…

READ MORE ⟶Here’s one financial decision you will not regret: enrolling in a Health Savings Account (HSA) at work to reduce your healthcare costs. Learn about the triple tax-reducing power of the Health Savings Account to lower your healthcare costs, and how it can help pay for health expenses from early career all the way through retirement.…

READ MORE ⟶Most financial “advisors” receive minimal training and while many eventually end up becoming competent, they leave damage behind in the process. Our new clients often wonder why I might have a couple of extra team-members in one of our meetings. The extra cast will be sitting quietly, taking notes. The answer is that I am…

READ MORE ⟶Cary Stamp, CFP®, Jupiter, Florida-based financial advisor, addresses a question that you should ask any financial professional that you consider working with: How is your financial advisor paid? In the case of Cary Stamp & Co., when you do better, we do better. Our transparent fee structure mutually aligns our interests with yours. Always make…

READ MORE ⟶If you have somebody who understands the big picture and is bringing your financial/accounting/legal advisors together, you will achieve far better outcomes for your family’s financial and estate planning. TRANSCRIPT: Today’s subject is the concept of collaboration. I firmly believe that as a financial advisor and CERTIFIED FINANCIAL PLANNER that I should be in contact…

READ MORE ⟶I am attending the Barron’s Independent Summit in Salt Lake City for the next few days. Ric Edelman, a well-regarded advisory firm founder, author and entrepreneur has assembled a group of experts to discuss the future of digital currencies. I admit that I have been a skeptic, so I wanted to understand what the proponents…

READ MORE ⟶If you were born during the baby-boom generation, then it is not very likely that your parents shared information with you about their finances. Perhaps, in their final years or when one parent passed away, they might ask for help but the prior generation was fairly tight-lipped about money. That generation lived through the depression,…

READ MORE ⟶As we prepare for tax season, it is a good idea to start thinking about how we can structure our finances, investments and charitable planning to give us a better outcome a year from now. The following are a few ideas we are discussing with our clients; Bunch your charitable giving. With a standard…

READ MORE ⟶Few children come by wealth management naturally. For most young children, money just buys stuff. As they age, they think philanthropy sounds good, but it competes with immediate gratification. Real estate and taxes are complicated. Securities and the markets in which they trade are mostly intangible. Despite the barriers, you can teach your adult children…

READ MORE ⟶