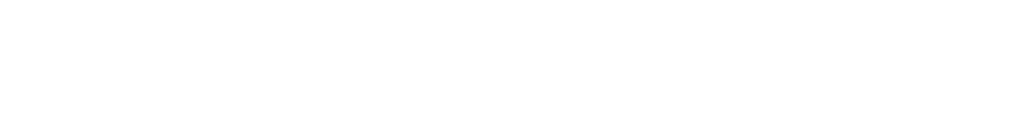

Tax Credits for College-Aged Kids You may be making a mistake if your kids are college-age and you’re not taking advantage of the American Opportunity Tax Credit and Lifetime Learning Credit. In this video, Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP®, provides an overview of these two significant tax credits available to families with more…

READ MORE ⟶When selling your home, you may be eligible for a substantial capital gains tax exclusion ranging up to $500,000 in excluded gains. Financial analyst Matt Mellusi, MSFP, of Cary Stamp & Co. in Tequesta, FL introduces the basics of the $250,000/$500,000 Home Sale Tax Exclusion. TRANSCRIPT: I’m Matt with Cary Stamp and Company and today…

READ MORE ⟶Leading financial advisor Cary Stamp, based in Jupiter, FL, offers an overview of the exceptional tax credits up to $5,000 per year for businesses that launch new 401k plans (made available through a Secure Act provision). TRANSCRIPT: Hi, I’m Cary Samp with Cary Stamp & Co., and this is a Principled Wealth…

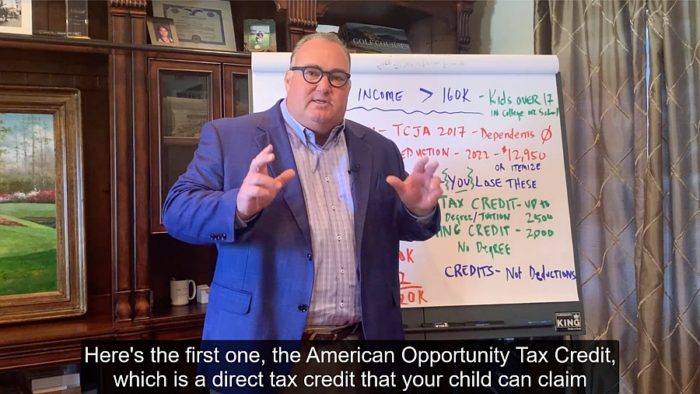

READ MORE ⟶What’s in the Secure Act? Financial advisor Cary Stamp addresses the four primary ways the recently passed Secure Act will affect individuals and families, most notably on Individual Retirement Accounts (IRAs) and 529 Education Plans. TRANSCRIPT: What’s in the Secure Act? I’m Cary Stamp. This is a principled wealth moment. Welcome to…

READ MORE ⟶Leading financial advisor Cary Stamp, CFP® discusses the tax efficiency benefits of Donor Advised Fund bunching deductions. TRANSCRIPT: Today I’d like to talk about how we can make the world a better place, and get some tax deductions all at the same time. And it’s by using a strategy that we call “Bunching Deductions.”…

READ MORE ⟶As we prepare for tax season, it is a good idea to start thinking about how we can structure our finances, investments and charitable planning to give us a better outcome a year from now. The following are a few ideas we are discussing with our clients; Bunch your charitable giving. With a standard…

READ MORE ⟶