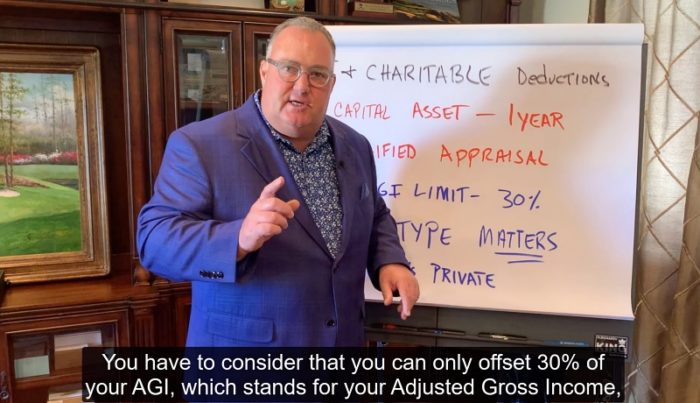

Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP®, combines his passion for fine art with decades of financial knowledge to share key issues involved in donating fine art to charities. There are some details that make all the difference. TRANSCRIPT: One of my passions is the art world and understanding art. And I like to couple…

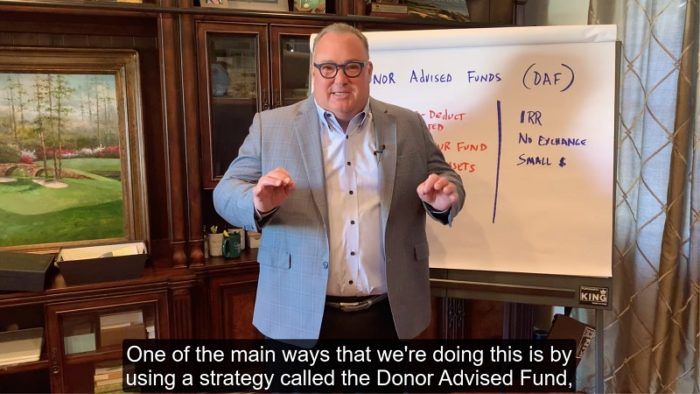

READ MORE ⟶Surprisingly, Donor Advised Funds and Foundations Don’t Really Have Much in Common Other Than Philanthropic Impact. The two most popular charitable vehicles for donors who possess considerable assets are the Donor Advised Fund and Private Foundation. The two have obvious differences and the contrast leads to a clear choice for most donors. A donor-advised fund…

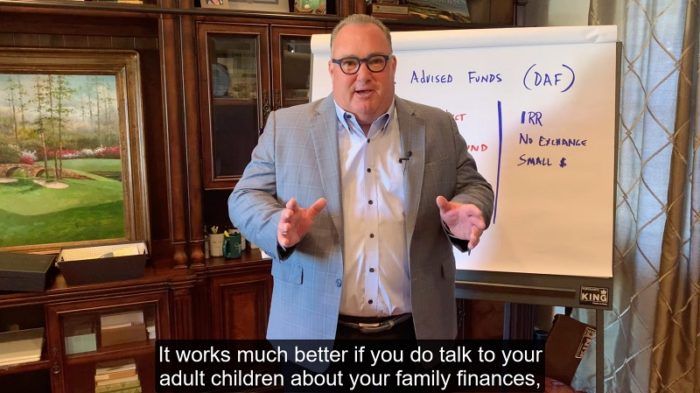

READ MORE ⟶Forbes Best-In-State Wealth advisor Cary Stamp, CFP®, introduces the concept of multigenerational family philanthropy, outlining the profound benefits of including teen and adult children in philanthropic discussions. VIDEO TRANSCRIPT: Hi, I’m Cary Stamp, I’m a Certified Financial Planner and I’m a Chartered Advisor in Philanthropy, and I’d like to talk today about how you can…

READ MORE ⟶Cary Stamp, CFP® in Jupiter, FL describes the considerable tax and administrative benefits of using a Donor Advised Fund for charitable giving. Mr. Stamp is a Forbes Best-In-State wealth advisor. VIDEO TRANSCRIPT: I’m Certified Financial Planner, Cary Stamp. I’m also a Chartered Advisor in Philanthropy, and over the last three years, we’ve helped our clients’…

READ MORE ⟶This March, through our program Cary Stamp Cares, we were fortunate enough to be a part of three fantastic charity events. On March 3rd, a few lucky members of our office were able to attend the 2nd annual Golf and Give, an event created by the group Suits for Seniors. This group, headed by founder…

READ MORE ⟶Highly-Rated Sustainable-ESG Assets Offer the Comfort of Having a Constant Positive Impact. The purpose of creating a Planned Giving strategy at any level of wealth is to formalize, in a tax-efficient manner, your desire to give back to the entities and causes that are close to your heart. It’s a noble process that has positive…

READ MORE ⟶Leading financial advisor Cary Stamp, CFP® discusses the tax efficiency benefits of Donor Advised Fund bunching deductions. TRANSCRIPT: Today I’d like to talk about how we can make the world a better place, and get some tax deductions all at the same time. And it’s by using a strategy that we call “Bunching Deductions.”…

READ MORE ⟶Considering charitable giving on a larger scale? A Donor Advised Fund is your simplest, least expensive, and most tax-efficient option. In brief, a Donor Advised Fund serves as your own tax-advantaged, donor-controlled philanthropic fund. The fund can be established easily through a broker-dealer, your financial advisor, or if you have a specific charity in mind,…

READ MORE ⟶ TRANSCRIPT of Charitable Giving and Philanthropy: I’m Cary Stamp and this is a Principled Wealth Moment. Most of the families that we work with are charitably-inclined. One of the things that a lot of people don’t realize is, with the new tax laws, there are some ways that you should be making your…

READ MORE ⟶