In an era where retirement planning has become increasingly complex, individuals are searching for ways to secure their financial future and ensure a comfortable life during their later years. One innovative tool that has gained prominence in retirement planning discussions is the Qualified Longevity Annuity Contract, or QLAC. Designed to address the challenges posed by…

READ MORE ⟶Here’s one financial decision you will not regret: enrolling in a Health Savings Account (HSA) at work to reduce your healthcare costs. Learn about the triple tax-reducing power of the Health Savings Account to lower your healthcare costs, and how it can help pay for health expenses from early career all the way through retirement.…

READ MORE ⟶When selling your home, you may be eligible for a substantial capital gains tax exclusion ranging up to $500,000 in excluded gains. Financial analyst Matt Mellusi, MSFP, of Cary Stamp & Co. in Tequesta, FL introduces the basics of the $250,000/$500,000 Home Sale Tax Exclusion. TRANSCRIPT: I’m Matt with Cary Stamp and Company and today…

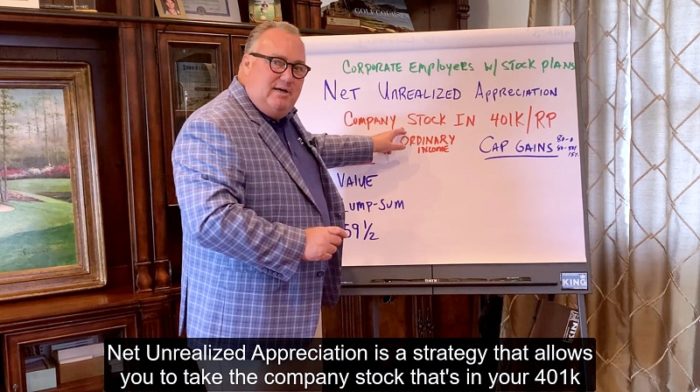

READ MORE ⟶Forbes Best-In-State Wealth Advisor, Cary Stamp, CFP® of Jupiter, FL, illustrates the huge tax advantage of using the Net Unrealized Appreciation strategy when distributing your employee-owned stock. TRANSCRIPT: My name is Cary Stamp. I’m a certified financial planner and founder of Cary Stamp & Company. And if you are an employee of a large corporation…

READ MORE ⟶Here’s the big question to ask yourself before starting a “backdoor” Roth IRA strategy. Do you already have other IRAs? In this video, Forbes Best-In-State wealth manager Cary Stamp, CFP® explains how the Backdoor Roth Pro-Rata Rule impacts the tax efficiency of the backdoor Roth IRA, and provides the potential solution! TRANSCRIPT: I’m Certified Financial…

READ MORE ⟶The maximum monthly Social Security benefits for 2022, and why the timing of claiming benefits is important for everyone. As high earners approach retirement, too many overlook the importance of claiming social security benefits at the optimal time. A number of personal reasons or assumptions are to blame for the blasé attitude. The most common…

READ MORE ⟶Current Tax Discussions in Congress May Lead to Drastic Changes in Estate Tax Exemptions that Increase the Value of a Roth IRA Conversion Strategy. For years, I’ve been stressing the benefits of Roth IRAs to our clients and their beneficiaries. In an environment of massive government spending and a constantly greater need to pay for…

READ MORE ⟶The Secure Act eliminated the Stretch IRA option for beneficiaries to distribute inherited IRAs over their lifetimes. Now there’s a 10-year distribution maximum. If you’re close to retirement, have a lot of money in retirement plans, and want to maximize assets passed on to beneficiaries when you’re no longer here, there’s a great solution. …

READ MORE ⟶Cary Stamp, leading financial advisor based in Jupiter, FL, provides an update on beneficial CARES Act provisions for retirement accounts—including IRAs and 401(k)s—to help with the financial challenges of the COVID-19 crisis. TRANSCRIPT: Hi, I’m Cary Stamp. This is a Principled Wealth Moment. I would like to share with you some updates…

READ MORE ⟶Leading financial advisor Cary Stamp, based in Jupiter, FL, offers an overview of the exceptional tax credits up to $5,000 per year for businesses that launch new 401k plans (made available through a Secure Act provision). TRANSCRIPT: Hi, I’m Cary Samp with Cary Stamp & Co., and this is a Principled Wealth…

READ MORE ⟶