Here’s one financial decision you will not regret: enrolling in a Health Savings Account (HSA) at work to reduce your healthcare costs. Learn about the triple tax-reducing power of the Health Savings Account to lower your healthcare costs, and how it can help pay for health expenses from early career all the way through retirement.…

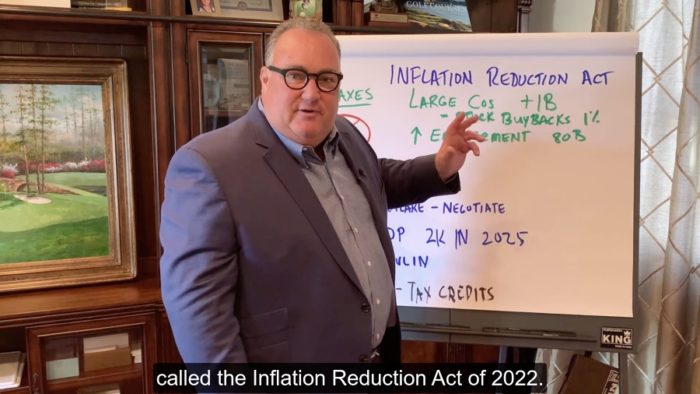

READ MORE ⟶Here’s Cary’s quick summary of key takeaways from the Inflation Reduction Act signed by the president last week, with emphasis on how it may affect you and your family. Recently, the US Congress, House and Senate and Joe Biden signed off on legislation called the Inflation Reduction Act of 2022. The act has a bunch…

READ MORE ⟶When selling your home, you may be eligible for a substantial capital gains tax exclusion ranging up to $500,000 in excluded gains. Financial analyst Matt Mellusi, MSFP, of Cary Stamp & Co. in Tequesta, FL introduces the basics of the $250,000/$500,000 Home Sale Tax Exclusion. TRANSCRIPT: I’m Matt with Cary Stamp and Company and today…

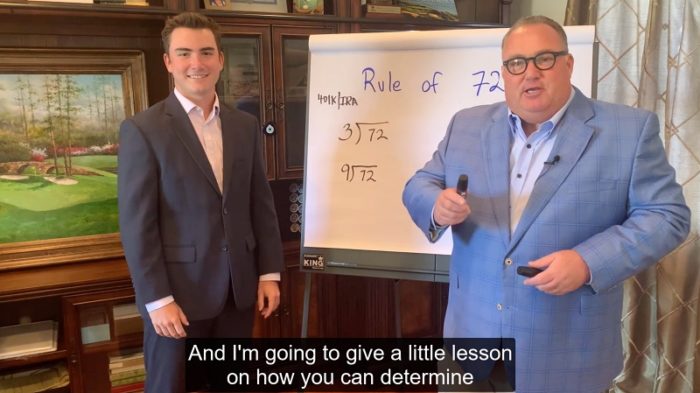

READ MORE ⟶The Rule of 72 is a simple arithmetical equation approximating how long to double your investment at an annual rate of return. In this video, Cary Stamp, CFP® and financial analyst Austin Kuyrkendall explain the power of investing your assets over the long term at a higher rate of return, using the Rule of 72.…

READ MORE ⟶